Is a strengthening south-south regional integration possible?

The case of Mercosur and Latin America

Résumé

Cet article vise à analyser les difficultés de l'intégration régionale en Amérique Latine et en particulier le cas du Mercosur. Il montrera que le régionalisme ne s'est réellement développé qu'après la guerre froide, à une période qui coïncidait avec la dominance du Consensus de Washington, ce qui a signifié l'abandon des politiques d'industrialisation basées sur la substitution aux importations. Le contexte économique global a renforcé la spécialisation des économies du Mercosur et celles du reste de l'Amérique Latine dans le rôle de fournisseurs de matières premières et de produits agricoles. Cela a engendré une plus grande instabilité macroéconomique de ces économies et de plus grandes tensions entre les pays membres du Mercosur. Cela a également affaibli la capacité du lobby industriel d'influencer les politiques économiques. La faiblesse relative de l'industrie dans cette région explique pourquoi la régionalisation générée par la dynamique microéconomique des firmes sera plus faible qu'au sein d'autres processus d'intégration régionale tels que l'UE, l'ALENA ou l'ANASE pour lesquels cette dynamique joue un rôle décisif.

Abstract

This article will look at the structural difficulties that regional integration faces in Latin America and in particular will analyze the evolution and prospects of Mercosur. It will show that regional integration could only fully develop at the end of the Cold War but this period coincided with the adoption of the Washington Consensus and that meant that the largest Latin American economies renounced to a substantial part of their import substitution industrialization policies. The global economic context reinforced the specialization of Mercosur and the rest of South American economies on commodities and energy sectors. This has generated a higher macroeconomic instability and more tensions between the member States of the Mercosur. It has also weakened the lobby of industrialists in shaping economic policies. The relative weakness of the industry in this region explains why the enterprise-driven regionalization will be weaker than in other regional integration processes such as the EU, NAFTA or ASEAN where it played a decisive role in the deepening of the economic integration.

Introduction

1This article will look at the structural difficulties that regional integration faces in Latin America and in particular will analyze the evolution and prospects of Mercosur. It will show that regional integration could only fully develop at the end of the Cold War but this period coincided with the adoption of the Washington Consensus and that meant that the largest Latin American economies renounced to a substantial part of their import substitution industrialization policies. The global economic context reinforced the specialization of Mercosur and the rest of South American economies on commodities and energy sectors. This has generated a higher macroeconomic instability and more tensions between the member States of the Mercosur. It has also weakened the lobby of industrialists in shaping economic policies. The relative weakness of the industry in this region explains why the enterprise-driven regionalization will be weaker than in other regional integration processes such as the EU, NAFTA or ASEAN where it played a decisive role in the deepening of the economic integration.

2Section 2 of the article will look at the roots of the regional integration processes in Latin America that emerged in the 1990s. It will show that these processes could not take place the throughout the 20th century because of two main factors. The first is the geopolitical context of the Cold War which gave the US government a strong leverage inside the domestic politics of Latin American government and Washington was opposed to Latin American regional integration schemes. The second is the competing nationalist import substitution industrialization strategies that prevented intraregional liberalization. The regional integration process really took off with the end of the Cold War and the scaling down or phasing out of import substitution policy and a higher degree of trade liberalization.

3Section 3 will highlight the structural economic weaknesses of the Mercosur integration process. It will explain than their greater exposure to macroeconomic shocks (compared to advanced industrialized economies) which put a strain of regional solidarity, secondly, an uneasy geographical location and inadequate transport infrastructure to develop a strong manufacturing sector inserted in international global production networks.

4Section 4 and 5 outlines the serious challenges faced by the Mercosur process by analysing the difficulties of Mercosur member states to break away from their specialized role of commodities providers for the industrialized countries, the EU, the US and East Asia and what this specialization means for regional integration processes in Latin America. The article then address the issue of competing integration projects in the light of this increasing economic specialization based on commodities.

The historical roots of Latin American regional integration in the late 20th century

The geopolitical weight of the Cold War and regional integration in Latin America

5The Americas have been characterized by competing integration projects since the end of the Cold War. In the early 20th century, US firms began to internationalize and challenge the hegemonic commercial position of Great-Britain in Latin America after WWI1. The rise of US multinational enterprises (MNEs) was accompanied by a more interventionist diplomacy in which the US government attempted to take the regional leadership of the continent and marginalize the influence of European powers2. Latin America was perceived in the US as their “backyard”, both economically and geopolitically. It did not prevent some Latin American governments, notably after the 1930s crisis such as Vargas, Cardenas or Peron to adopt policies to strengthen their bargaining position in the global economy and to attempt to develop some, although limited, economic autonomy vis-à-vis the US or Europe, notably through import-substitution industrialization.

6These attempts by the governments to gain more sovereignty and by some indigenous bourgeoisies to develop a stronger industry capable of strengthening their capital accumulation capacities vis-à-vis their European and US competitors led the largest Latin American economies toward protectionist policies in the aftermath of WWII. However given the technologies generated by the fordist industrial production methods, the size of the Latin American national economies, even the largest ones such as Brazil, Mexico or Argentina, was not sufficient for indigenous firms to benefit from sufficient economies of scale to compete against their American or European counterparts in many key industrial activities3. Therefore some technocrats and Latin American economists began to argue in favour of regional integration schemes such as ALALC in the 1960s (ALADI in the 1980s)4. The US government opposed such attempts to develop a closed regionalism. The context of the Cold War enabled the successive US administrations to interfere in Latin American domestic politics in the name of the containment of communist subversion with institutions like the US Army School of the Americas or Kennedy’s Alliance for Progress. Using military and financial leverage, the US government did not only sponsored anticommunist governments, many of them highly repressive open military dictatorships or governments using illegal paramilitaries to eliminate left-wing civilian militants or guerilleros5. The US also used their geopolitical leverage to impose their economic agendas, conditioning their support to the opening of Latin American economies to US FDI. The US government opposed Latin American regional integration schemes, the obvious example being the radical economic policy change in Chile by the CIA-backed Pinochet dictatorship that reversed the support to the Andean Pact pursued by the governments of Frei and Allende6. Pinochet and his “Chicago Boys” team adopted a free trade policy that gave up most of the ISI and accepted to develop mostly though the exports of commodities.

7Naturally, it was not only the US interference that prevented regional integration but rivalries between indigenous firms from each member state of the region, notably a fear take the domestic industry of some member states would be eliminated by stronger competitors from other member states. Andean Pact member states were afraid of competition from Chilean firms and in the ALALC-ALADI from Brazilian, Argentine or Mexican ones. The ISI policies were highly protectionist and generated a stalemate in regional integration processes across Latin America that lasted until the debt crisis of the 1980s7.

The conditions for the launching of new integration processes based on an “open regionalism” across Latin America in the 1990s

8It was only after the end the Cold War and the return to civilian governments with less US interference in Latin American domestic politics that indigenous governments enjoyed a greater room for manoeuvre. Furthermore, the pro-British position of the Reagan administration during the Falklands-Malvinas war generated tension in inter-American relations and a desire to reassert a more independent strategic position by Argentina and Brazil8.

9The late 1980s saw the emergence of new wave of regional integration schemes. These were partly driven by launching of the European Single Market (ESM) and a development of competing regional blocks launched by various countries of the different regions to avoid isolation in the context of stalemate at the Uruguay round negotiations in the early 1990s9. The FTAA, NAFTA, MERCOSUR, the ASEAN FTA, the Common External tariff of the CAN were all negotiated in the early 1990s.

10The flurry of regionalism across emerging economies in Latin America, Asia and Africa was not only caused by competitive liberalism and by the fear of Fortress Europe after the adoption of the ESM in 1993. It was also provoked by a radical change of economic policy across the developing countries. In the 1980s and 1990s, the debt crisis and the structural adjustment programmes imposed by the international financial institutions weakened considerably the scope of import substitution industrialisation and vertical industrial policies across many developing economies, especially in Latin America. Analysis inspired by List, Hamilton and the dependency theories were replaced by a neoliberal approach that was labelled the “Washington consensus” coined by the World Bank economist Williamson10.

11The dominant neoliberal economic paradigm considered that opening to trade and attracting FDI to create export platform, to generate management and technological spill-over was the most efficient way to insert a developing country into the globalizing economy and ensure sustainable growth. Regional integration was not primarily seen as a way to develop a national industry but rather as a mean to attract MNEs and enable them to operate more efficiently at the regional level (rather than at the too narrow national level)11. MERCOSUR under Menem and Collor, NAFTA under Salinas and the Common External Tariff of the CAN were designed within this new neoliberal paradigm that was very different from the one developed by Prebisch at the CEPAL. These regional integration schemes were “open regionalism” that favoured greater intraregional and international competition and a drastic reduction of the state in the national economy through massive privatisation schemes, notably under Menem’s Argentina and Salinas’ Mexico.

Mercosur and its structural weaknesses

12Despite a promising start in 1995, after two decades, Mercosur proved disappointing in terms of deepening economic ties in the region and generating a high interdependency. It also failed to lower TBTs and impose a truly integrated single market compared to regional integration schemes including advanced industrialized economies (NAFTA, EU, EU-Turkey Custom Union, Japan EPAs in East Asia).

Table 1. The evolution of MERCOSUR trade flows for Argentina and Brazil

Argentina’s trading partners 1988-2013

|

Argentina |

Brazil |

Uruguay |

Venezuela |

Paraguay |

Mercosur |

China |

NAFTA |

EU 28 |

|

import |

||||||||

|

1988 |

8,6 |

2,1 |

1,2 |

0,6 |

12,5 |

4,8 |

20,9 |

38 |

|

1993 |

24 |

3,2 |

1,6 |

1,8 |

30,6 |

|||

|

1998 |

31 |

3,1 |

1,2 |

1,9 |

37,2 |

|||

|

2003 |

15 |

1,8 |

0,5 |

1,4 |

18,7 |

|||

|

2008 |

16 |

3 |

1,4 |

1,6 |

22 |

|||

|

2013 |

20 |

2,3 |

2,8 |

1,5 |

26,6 |

7,2 |

9,1 |

13 |

|

Argentina |

Brazil |

Uruguay |

Venezuela |

Paraguay |

Mercosur |

|||

|

export |

||||||||

|

1988 |

2,6 |

1,2 |

1,4 |

0,9 |

6,1 |

2,5 |

29 |

32 |

|

1993 |

9 |

1,6 |

1 |

1 |

12,6 |

|||

|

1998 |

13 |

1,6 |

1,2 |

1,6 |

17,4 |

|||

|

2003 |

5,8 |

0,6 |

0,7 |

0,8 |

7,9 |

|||

|

2008 |

7,9 |

0,7 |

1,9 |

1,1 |

11,6 |

|||

|

2013 |

7,9 |

0,8 |

2 |

1,1 |

11,8 |

19 |

12,8 |

20 |

Brazil’s trading partners 1988-2013

|

Brazil |

Argentina |

Uruguay |

Venezuela |

Paraguay |

Mercosur |

China |

NAFTA |

EU 28 |

|

import |

||||||||

|

1988 |

4,4 |

1,9 |

0,9 |

0,7 |

7,9 |

0,8 |

25 |

27 |

|

1993 |

12 |

1,5 |

1,4 |

1 |

15,9 |

|||

|

1998 |

14 |

1,8 |

1,4 |

0,6 |

17,8 |

|||

|

2003 |

9,6 |

1,1 |

0,6 |

1 |

12,3 |

|||

|

2008 |

8 |

0,6 |

0,3 |

0,4 |

9,3 |

|||

|

2013 |

6,6 |

0,4 |

0,7 |

0,6 |

8,3 |

15 |

16,5 |

19 |

|

Brazil |

Argentina |

Uruguay |

Venezuela |

Paraguay |

Mercosur |

|||

|

export |

||||||||

|

1988 |

2,6 |

1,2 |

1,4 |

0,9 |

6,1 |

2,5 |

29 |

32 |

|

1993 |

9 |

1,6 |

1 |

1 |

12,6 |

|||

|

1998 |

13 |

1,6 |

1,2 |

1,6 |

17,4 |

|||

|

2003 |

5,8 |

0,6 |

0,7 |

0,8 |

7,9 |

|||

|

2008 |

7,9 |

0,7 |

1,9 |

1,1 |

11,6 |

|||

|

2013 |

7,9 |

0,8 |

2 |

1,1 |

11,8 |

19 |

12,8 |

20 |

Observatory of Economic complexity 2015, MIT, http://atlas.media.mit.edu/en/

13One can see that the peak of Mercosur intraregional trade took place in 1998 and has been declining since then with a slight increase in the 2009 crisis in the real economy. Asia, and first of all China, have gained importance in the trade of all Mercosur partners. This trend is different from the regional integration processes such as the EU, ASEAN or NAFTA where the share of Asia has been also increasing but without such a marked relative decline of intraregional trade. Two elements explain this decline of economic interdependency within the Mercosur: macroeconomic shocks and trade specialisation.

The Mercosur members’ economies face greater and more recurrent macroeconomic shocks

14Firstly, in terms of macroeconomic shocks one must mention the consequences of the financial crisis that hit the region in the late 1990s on the on the MERCOSUR integration process. After the East Asian and Russian financial crisis, financial speculation hit Brazil in 1998 and forced the government to impose a drastic devaluation of 40%12. This generated a substantial boost of Brazil’s exports in 1999 but as Argentina exchange rate policy was characterized by a pegging to the US dollar with a currency board since 1991, causing a relative deterioration of Argentine products competiveness, especially within Mercosur. This generated a strong trade deficit and a rise of unemployment. Brazil’s policies were not the sole culprit but it aggravated an already difficult situation for Argentina who then had to suffer a major economic crisis (12% fall in income in 2002 alone) between 1999 and 2002. The unemployment level and the balance of payment forced a radical and painful adjustment with unpopular economic measures and an unprecedented level of political repression since the end of the military dictatorship that forced president de la Rúa out of office in 2001. The new leadership of the Kirchner between 2003 and 2015 was characterized by a will to regain economic sovereignty vis-à-vis the IMF but also vis-à-vis foreign investors, most of all Spanish enterprises that had taken over key strategic assets during the vast privatization schemes of the Menem administration. During this period, the economic relations between Argentina and Brazil were not as good as at the earlier years of the Mercosur. The tension between Mercosur members and their incapacity to reach common positions on trade issues was visible. This explains in part the choice of the EU to give up in 2004 its interregional negotiation with the Mercosur for an association agreement because of the trade chapter13. The EU tried instead to conclude first a bilateral deal with Brazil, hoping that it would then convince other Mercosur members to follow.

15This episode of tension between Argentina and Brazil show how macroeconomic shocks can create a revival of economic (and political) nationalism and their protectionist outbursts. This phenomenon can also be observed in the EU since the crisis of 2008 with the rise of xenophobic parties that are demanding a restriction on intra-EU flows and a reversal of EU integration policies. The problem of Mercosur compared to the EU is that their economy is not as developed. Their less diversified export structures relies much more heavily on commodities than the core of the EU member states. This generates a much higher volatility of the balance of payment among MERCOSUR member states. If one compares Germany, France UK and France (the three biggest and most influential member states) with Brazil and Argentina, the volatility of growth, unemployment and balance of payments is considerably higher for the Latin American economies, highlighting the risk of political tensions and protectionism.

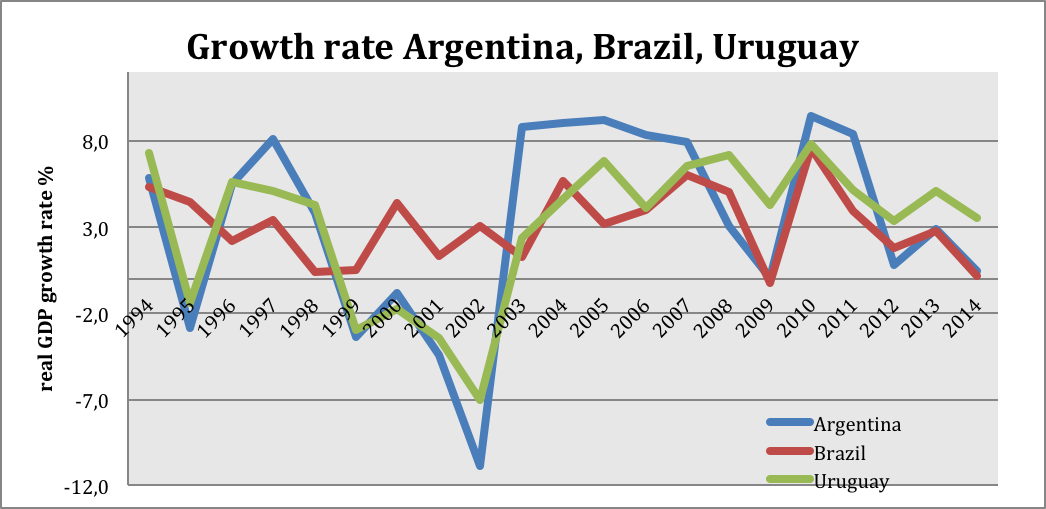

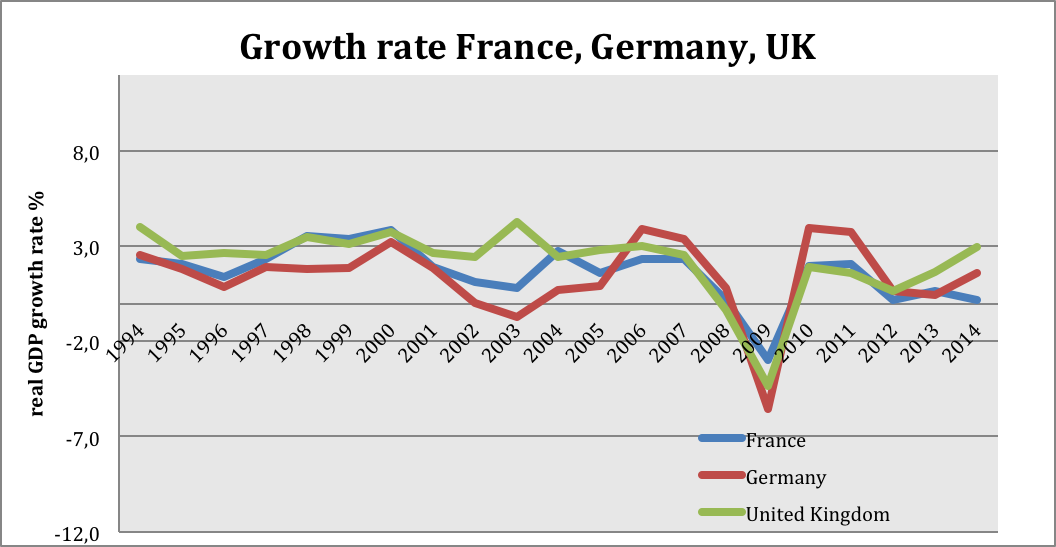

Graph 1. GDP annual growth

16Indeed, except for the global systemic crisis of 2009 France and Germany experienced mild recessions and limited balance of payment problems during these last 25 years. Even the 2009 recessions for Germany and France does not compare to the severe shocks experienced by Mercosur members. Apart from Spain, only smaller economies of the EU periphery experienced shocks similar to those of Mercosur’s member and with a much lower recurrence. These small economies do not constitute more than 10% of the EU economy or 25% than its population and therefore they do not have the economic and political weight to reverse EU policies that are deepening the level of integration in Europe.

Mercosur increased specialization in the export of commodities and its consequences on regional integration

17The second cause behind the relative decline of intra-Mercosur trade is the important share of commodities in their economy and exports. The share of the primary sector in the national economies of Mercosur is much higher than in the EU or NAFTA, even the most rural EU member states such as Romania or Poland are far less reliant on their primary sector. When it comes to trade, the difference is even greater, showing a low and stable share of manufactured trade in the total trade of the various Mercosur members for the last two decades. The relative importance of primary goods in the export structure of Mercosur’s members has important implications regarding the bottom-up process of regionalization driven by enterprises and other economic actors.

18Since the 1990s, drastic technological developments of transport and telecoms combined with a greater opening of developing world economies to FDI enabled MNEs to internationalize their production processes according the location-specific advantages of various countries. These efficiency-seeking investments and outsourcing mechanisms became increasingly important these last two decades as some estimates put a one-third of global trade, the share of intra-firm trade in the late 2000s14. Many authors have highlighted the fact have shown that the structure of the globalized production processes of the MNEs is often characterized by the development of relatively autonomous production processes organized at the regional level (Europe, North America, South America, East Asia)15. This is the microeconomic driving force referred as regionalization which generates a bottom-up strengthening of regional integration. Intraregional intra-industrial vertical trade is growing as a result of this driving force. These firms operating at the regional level constitute an important lobby to support regional institutions that facilitates the regionalization of their production processes.

19Empirical evidence has shown that some firms located in the Mercosur region, many of them foreign-based MNEs, have experienced such a regionalization process and have generated a constituency in favour of the deepening of Mercosur16. Nevertheless, the aggregate figures show that their lobbying forces must be far smaller than those of the agribusiness, mining or energy industries.

Table 2. The importance of the secondary sectors for MERCOSUR member states. (source: World Bank Stats 2015)

|

% of sector in GDP |

primary |

secondary |

tertiary |

|||

|

Argentina |

10.0 |

30.7 |

59.2 |

|||

|

Brazil |

5.5 |

27.5 |

67.0 |

|||

|

Paraguay |

23.1 |

18.6 |

58.3 |

|||

|

Uruguay |

9.4 |

21.7 |

68.9 |

|||

|

Germany |

0.8 |

28.6 |

70.6 |

|||

|

France |

1.8 |

18.8 |

79.4 |

|||

|

Italy |

2.0 |

24.7 |

73.4 |

|||

|

Romania |

7.9 |

32.9 |

59.2 |

|||

|

Manufactured exports as % of total exports |

1996-2000 |

2001-2005 |

2006-2010 |

2011-2015 |

||

|

Argentina |

32 |

32 |

33 |

32 |

||

|

Brazil |

34 |

35 |

36 |

35 |

||

|

Paraguay |

8 |

9 |

8 |

9 |

||

|

Uruguay |

28 |

24 |

24 |

24 |

||

|

Germany |

83 |

82 |

83 |

83 |

||

|

France |

76 |

77 |

77 |

78 |

||

|

Italy |

82 |

82 |

82 |

83 |

||

|

Romania |

78 |

77 |

76 |

76 |

||

20Brazil is by far the heavyweight of Mercosur and the Brazilian largest firms that belong to the 500 largest global firms are in agribusiness, mining, energy and in banking. The level of regional integration in these industries is generally lower because of numerous technical barriers that remain determined at the national level (this still occurs even for a deep integration such as the EU).

21Regarding the energy industry, its integration across Latin America was still limited at the end of the 2000s with a low level of harmonisation or compatibility across the region. Furthermore, the largest energy projects in Latin America were developed independently of Mercosur such as the South Gas Pipeline Network, designed at the level of South America and not specifically Mercosur. The joining of Venezuela combined with a more nationalist industrial policy on energy by the Kirchner administration has generated a momentum for deeper integration in the energy sector at the Mercosur level and intraregional energy trade is on the rise17 but it is still early to measure its concrete effects on the ground and it has not generated a coherent Mercosur policy on energy.

22These elements show that the regionalization process exist in the Mercosur but that it is relatively weaker than in other regional integration processes which host a larger share manufacturing activities and domestic-based MNEs engaged in manufacturing and services.

23The 2000s have seen a relative strengthening of the primary sector across Latin America except for Mexico and a few other Central American economies (i.e. Costa Rica18) that became integrated in the regionalization of the production processes of US-based MNEs in manufacturing. For South American economies, the stronger demand from the emerging industrialised Asian economies and, most of all, from China has generated a steady increase off commodities world prices since 2000. Asian-Latin American trade has been developing at an unprecedented pace, China becoming one of the three top partners of Latin American economies19. This trade has been characterized by imports of Asian manufactured products being exchanged for Latin American commodities. This has led to a relative decline of manufacturing of many Latin American economies and reinforced their traditional comparative advantage in commodities20. That does not mean that trade in manufacturing did not increase in absolute terms but that the lobbying power of firms engaged in manufacturing activities is likely to weaken compared to those engaged in the production of commodities.

24This evolution has serious implications for the future of the regional integration in Latin America. This reinforcement of the traditional comparative advantage in commodities could weaken the technological base of the continent in the long run. Naturally, the large Brazilian groups in commodities, mining and energy are capital intensive and master advanced technologies such as off-shore drilling or GMO. Nevertheless, these technologies are quite industry-specific and have less linkage with the rest of the domestic economy. The situation for other Latin American groups is more worrying with almost no firms in the global largest 500 firms. Apart from the Brazilian firms described above, one can only find two companies in the global 500 largest firms 21. The first is Antar Chile, ranked 497th and far smaller than their leading counterparts in the energy industry which is part of the Angelini conglomerate focusing on commodities. The second is PVDA, the giant Venezuela national oil company that is well known for its technological difficulties and loss of qualified labour force22.

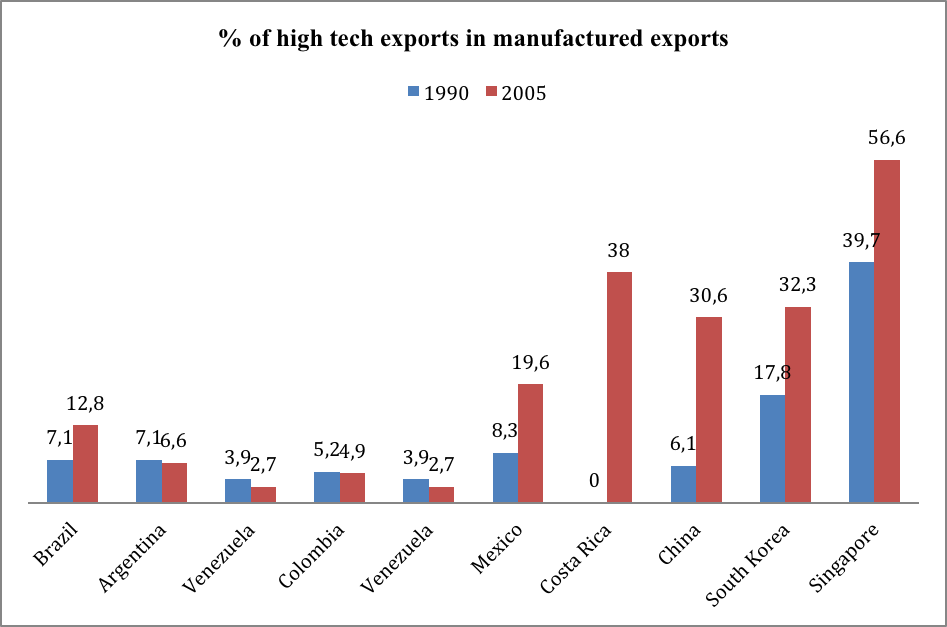

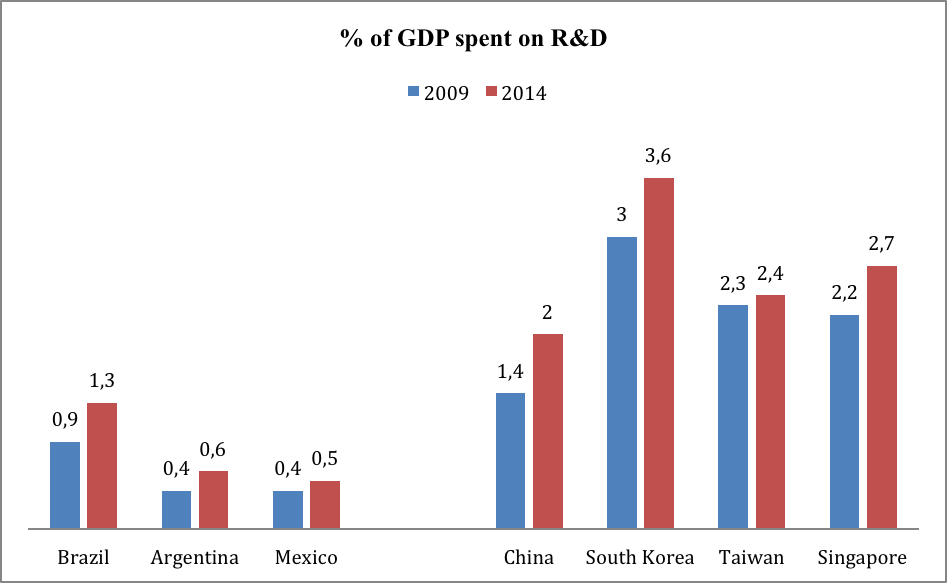

25Numerous empirical studies have shown that the existence of large global firms in the manufacturing industries that are domestically based generates the strengthening of the technological level of a national economy. The globalization of the production process and the generalization of outsourcing to emerging economies do not imply that the added-value is evenly distributed among the various countries involved in these globalized production processes23. The necessity for the most advanced large global firms to keep their technological edge vis-à-vis their outsourcing partners located in merging economies means that their top management have to limit as much as possible technological spill-over and intellectual property violations. For this reason, high-tech R&D centres are usually located in the home country of the firms or in the most technologically advanced countries with a strong enforcement of TRIPs24. External economies of scale in R&D have generated marshallian districts or business clusters that concentrates geographically high-tech activities and which are often closely located to the HQ of MNEs (e.g. route 128, Sillicon Valley, M4 corridor, Biovalley, Toyota city)25. Latin America remains one of the regions that hosts no major high-tech marshallian districts, contrary to Europe, North America and East Asia.

26This weakness can be seen by looking at basic indicators such as R&D spending in percentage of GDP, royalties per capita, number of international patent. These elements show that only Brazil can qualify as an intermediate level of technological development in the region. The worrying trend is that some Asian countries have been distancing themselves from their Latin American counterparts these last two decades. Some analysts are pointing at the increasing technological dependence of Latin American economies vis-à-vis not only traditional providers of technology such as the US and Europe but also vis-à-vis newly industrialized countries in Asia and notably China26. This could reinforce in the long run the specialization of Latin American economies towards commodities and local services rather than manufacturing and tradable services (often more technology-intensive).

|

Table 3. Indicators of R&D capacities |

|||||||||||||||||||

|

Country |

|

||||||||||||||||||

|

Argentina |

53,7 |

14,1 |

-2,0 |

0,0 |

|||||||||||||||

|

Brazil |

66,8 |

29,3 |

20,9 |

19,1 |

|||||||||||||||

|

China |

55,1 |

31,8 |

107,8 |

24,8 |

|||||||||||||||

|

Colombia |

-12,5 |

0,0 |

-13,7 |

0,0 |

|||||||||||||||

|

Germany |

147,6 |

106,7 |

133,6 |

120,2 |

|||||||||||||||

|

India |

60,3 |

2,2 |

9,9 |

20,5 |

|||||||||||||||

|

Japan |

98,3 |

48,7 |

157,5 |

147,5 |

|||||||||||||||

|

Korea |

136,3 |

70,8 |

170,2 |

107,2 |

|||||||||||||||

|

Mexico |

15,1 |

5,6 |

1,8 |

0,0 |

|||||||||||||||

|

OECD sample median |

100,0 |

100,0 |

100,0 |

100,0 |

|||||||||||||||

OECD stats 2015

|

Table 4. Share of high tech exports in manufactured exports |

OECD stats 2015

Table 5. Share of GDP spent on R&D

Batelle global R&D spending forecasts 2011 & 2015

27Manufacturing activities can also be brought in South America by foreign-based MNEs and contribute to an increase of vertical intra-industrial trade that could foster regional integration. Japanese MNEs have played such as role in the ASEAN and have increased intra-ASEAN trade since the late 1980s27. However, in the ASEAN case, the region was used as an export-platform by Japanese MNEs that wanted to go round trade friction with Western economies, benefit from the cheap labour and the weaker currencies (relatively to the yen) of the region28. Many Latin American economies do not share currently the same location specific advantages to attract this type of efficiency-seeking FDI. South America mostly attracts resource-seeking and market-seeking FDI. On the contrary, the Central American economies that are the biggest recipient of efficiency-seeking investment in Latin America are located geographically close to the US (Mexico, Caribbean and Central America) and are getting increasingly integrated with the US economy and less with South America29.

28One of the problem is the lack of an important economic centre in the South American region compared to Central America (close to the US centre), Eastern Europe and the Mediterranean (Western Europe centre), East Asia (Japan ,and since the 2000s China, that constitute a North Asian centre). These three regions located in a semi-periphery can benefit from the regionalization process launched by MNEs based in a relatively close economic centre. The situation is different for South America. Brazil might be an important economy but is only ranked 7th in the world, behind France30. It does not possess many domestic-based MNEs engaged in manufacturing activities that would generate a massive wave of efficiency-seeking FDI31. South America can be considered as relatively isolated from the centres of the world economy.

29Geographic distance does not constitute an insurmountable obstacle but the South American economies are characterized by a challenging topography and a relatively weak infrastructure compared to East Asia, Eastern Europe and the most advanced Mediterranean economies (Turkey, Israel or Morocco). Natural obstacles such as the Amazon and the Andes require high costs to develop transport infrastructure on land. The transport delays and costs to move goods around the region and to export them to major economic centres of the world economy are causing Latin America the loss of one major location-specific advantage necessary to attract efficiency-seeking FDI32. In these matters of transport infrastructure and geographic configuration, South America and Brazil are in an analogous situation than South Asia and India. They remain a semi-periphery with a limited manufacturing intra-industrial vertical trade with the centres of the world economy.

30The current situation of the Mercosur economies and their counterparts from the rest of South America is those of becoming providers of commodities while generating only a limited intra-regional trade in manufacturing industries. The reliance of foreign technology and the limited attractiveness for efficiency-seeking FDI means that these economies are likely to be characterized by large primary and tertiary sectors. As productivity gains or labour organization are generally more important in the long run in the manufacturing sector than in agriculture or low-tech services, a weaker industrial sector could continue to generate an unequal society with lower wages for the Latin American economies who experienced a limited industrialization. Such a divide can be seen these last two decades in Mexico between the industrialized Northern provinces inserted in the maquiladoras system fostered by the adoption of NAFTA and the rural south that remains far more unequal and suffers from lower wages33. It also implies a weaker domestic demand with less mass consumption and less possibilities of economies of scale, perpetuating a strong dependency on traditional exports revenues to generate growth.

31It seems therefore that the strengthening of the traditional comparative advantage based on the export of commodities across South American economies could constitute a serious limitation to the level of regional integration but also on the capacity to pursue a more balanced and stable growth. There has been a path dependency since the debt crisis of the 1980s which has weakened the technological base of many Latin American countries relatively to other regions of the world. Could the Mercosur economies break away from this path dependency and develop regional autonomous high-tech industrialization and built their own R&D marshallian districts? The experience of some Asian countries, Japan, Taiwan, Singapore, South Korea and more recently China prove that this possibility exist. Do the Mercosur economies meet the necessary conditions to follow the Northeast Asian path?

Can Mercosur follow East Asia and break from this path-dependency of commodities exporter?

32Half a century ago, the Northeast Asian economies faced similar problem to develop their national industries. Off-centred, in a geopolitically unstable region (Chinese revolution, Korean and Vietnam Wars) and with a limited domestic market that did not enable local firms to benefit from sufficient economies of scale in capital intensive industries, the conditions to develop an autonomous high tech industry or to attract FDI were far from favourable. Nevertheless, the governments of these economies embarked in ambitious industrial policies to develop a national industry that could produce capital and technology intensive goods and policies to attract FDI and foster technological and management know-how spill-over.

33One decisive exogenous factor that generated the necessary (although not sufficient) conditions for the emergence of these successes was the Cold War. The governments of Japan, South Korea, Taiwan and Singapore were all in a situation of survival with the risk of local communist uprisings and potential military external threats from the PRC and the USSR34. The effects of WWII had weakened the traditional oligarchies (Japanese colonizers had left Taiwan and Korea while US military occupation weakened considerably the traditional Japanese elites). In this context the US (and the British in the case of Singapore) developed strong military ties with these countries and became highly involved in the domestic politics to contain the risk of a communist uprising. To cut the social roots of communist support, the US administration advocated a land reform that generated a middle-class of farmers and weakened the traditional large landowners in the 1950s35. The US administration wanted to strengthen the industrial base of their East Asian allies in order to contribute militarily to the containment of communism in Asia. To achieve that purpose, the US government provided important aid to acquire US technology or even transferred it directly without any form of financial compensation. The US governments also helped theses countries to access international markets which enabled their industries to benefit from sufficient economies of scale. The military procurements of the US army in East Asia (notably during the Korea and Vietnam wars) constituted a very substantial part of their exports36. The US also gave these countries a privileged access to the US market and became quite lenient on trade-related property rights until the 1970s (after trade frictions between the US and their Asian trading partners of the US will increase). The US also supported actively the quick accession of these countries to international economic institutions, especially the GATT which enabled them to access more easily other overseas markets, notably Europe37. The exceptional situation of these countries characterized by a weakening of traditional rural landlord elites, a situation of political and military survival facing potential communist take-over and strong US financial, technological and military support strengthened considerably the indigenous governments vis-à-vis various traditional commodity-oriented constituency and gave them the capacity to enforce daring economic and industrial policies. The state developed land reforms, encouraged, and sometimes even forced, industrial leaders to engage in new risky capital intensive industries such as automobile, electronics or chemistry.

34China had a quite different experience being at first in the opposite Cold War block until Nixon’s turnaround in 1971. Nevertheless, the end of foreign occupation and the exile of traditional KMT economic elites gave the new revolutionary PRC state a large room for manoeuvre. It also benefited from massive free transfers of technologies from the USSR until 195838. The Korean and the Vietnam wars also generated a situation of survival and militarization of society that justified the launching of a capital-intensive industry in the name of the military preservation of national sovereignty39. As in the other northeast Asian economies, the government had sufficient room for manoeuvre to pursue a long term ambitious industrial policy. After 1971, the PRC then benefited from an implicit alliance with the US against the USSR. It soon adopted the open door policy to attract FDI, demanded to join the GATT in the mid 1980s and acceded to the WTO in 200140. The Chinese government opened up progressively the economy to MNEs to allow technological and management spill-over through joint-ventures with indigenous firms. Nevertheless, simultaneously, it continued to pursue an active industrial policy throughout the 1990s and 2000s to develop national champions in strategic capital-intensive industries41.

35The context in which the Northeast Asian states could develop a long-term industrial policy is radically different from the one experienced by South America. Even at the time of ISI from the 1930s to the 1970s which was only pursued by the largest and most advanced economies of Latin America (mostly Argentina, Brazil and Mexico), no Latin American government enforced radical changes comparable to those observed in East Asia. A stronger executive with a stronger role of the state in the economy emerged after the crisis of the 1930s with Vargas’ Estado Novo, Peron’s justicialismo or Cardenas’ nationalization of the oil and railroad industries42. Nevertheless, despite some successes, notably the establishment of the ejidos system under Cardenas, Latin American governments did not manage to weaken durably traditional landlord oligarchies and never proceeded with a land reform as radical as those experienced in Northeast Asia.

36Contrary to East Asia and Western Europe, the US did not support any strong industrial policy in Latin America. Firstly, there was no clear immediate military threat like in East Asia. Even after the spread of castrism in the 1960s and 1970s across Latin America, the risk was more a domestic communist subversion than an open war with important military force such as Korea or Vietnam43. While the US mobilized hundreds of thousands of troops in East Asia from the 1950s to 1980s, they had a maximum of 15,000 troops in the Americas (including Canada and the Bermudas) which highlights the totally different military context of the two regions44. The US did not need Latin America to industrialize for geopolitical military reasons, even after Castro seized power in 1959. The USSR was adopting its “peaceful coexistence” doctrine which accepted implicitly the US hegemonic position in the Western hemisphere, except for castrist Cuba who had not been anticipated or encouraged by the USSR and was considered as a defensive exception not to be replicated. The US could rely on the 21294 Latin American officers formed in their US School of the Americas to impose repression on leftist movements and contain leftist subversion with a limited technical help from the CIA and some US military advisers45. The US government did not provide their Latin American allies with free transfer of technology and did not encourage any active national industrial policy. On the contrary, the US Alliance for Progress launched in the 1960s gave a decisive role of US MNEs in generating a US controlled industrialisation across Latin America46.

37Furthermore, the US MNEs in capital-intensive sectors were participating to the ISI policies since the end of WWII. The US MNEs benefited from the ISI protectionist policies and the rents that they could generate with their dominant position in national economies across Latin America. They were not in favour of the pursuit of industrial policies by national government. US MNEs such as ITT opposed the nationalizations made by Allende. They supported actively Pinochet’s coup and the involvement of the CIA in the overthrowing of the Unidad Popular in 197347.

38As a result, the commodities’ lobbies controlled by traditional landlord elites have always been important and the largest firms in all Latin American countries are found in the primary sector along with utilities, banking and energy. The governments of the largest economies of Latin America pursued ISI from the 1940s to the 1980s but it was mostly an inward looking policy. The exports of Latin American economies were still being dominated by the primary sector. Manufactured products made in Latin America were made with an obsolete technology, provided by private MNEs from the US and Europe who did not want to see the emergence new competitors from Latin America. The small size of the Latin American domestic markets did not allow for sufficient economies of scale. For these reasons, Latin American manufactured products were not competitive enough to be successfully exported to the markets of the developed economies. This limited their rise in the domestic economy and their lobbying power to shape their own governments’ economic policies.

39When the debt crisis hit Latin America, the industrial base of the national economies was much weaker. The insolvency of most Latin American economies forced them to accept the IMF structural adjustment policies and turn away from state interventionism in the economy and especially industrial policy48. The indigenous manufacturing firms did not disappear all together but were seriously weakened, often taken over by foreign-based MNEs or became their junior partners.

40In the 2000s, the gap between East Asian and Latin American economies regarding industrial and technological capabilities was much higher than before the debt crisis. Furthermore, the geopolitical post-cold war context meant that US would not play the role of benevolent provider of free technology. On the contrary, the US government has tried to multilateralize the Washington consensus at the WTO through the Singapore Issues which provisions restricts considerably the capacity of WTO member state to pursue active industrial policy and reinforces the protection of intellectual property and FDI49. The current context is far less favourable for the development of an ambitious industrial policy in Latin America.

41The governments of new left that came to challenge the Washington consensus in many Latin American countries starting in 1999 with Venezuela and then with Brazil, Argentina, Bolivia or Equator did not fundamentally alter this situation. Their industrial policies remain limited and it is difficult to identify statistically significant progress of domestic technological capabilities in manufacturing activities50.

42This has serious implications for the development of the form of regional integration in Latin America. One of the motives of regional integration can be the pursuit of industrial policies by enabling indigenous firms to benefit from learning–by-doing effects and greater economies of scale in a larger and partly protected market51. This enables indigenous firms to improve their competitiveness in order to transform themselves into global MNEs. The use of a large domestic market with certain strategic protection to enable indigenous firms to resist better against their global competitors has been a key factor to explain the rise of MNEs from the EU, China, India or the ASEAN52. In the case of ASEAN and the EU, the will to establish a deeper integrated market at the regional level was an important factor in explaining the acceleration of regionalism in the 1990s53. If the Latin American states do not have the constituencies to adopt a more active industrial and R&D policy, it means that regional integration will not be as important because it will not be perceived as a necessary tool to transform indigenous manufacturing enterprises into global MNEs. Indeed, Mercosur might continue to be important for some foreign-based MNEs already present in the region as well as some of the few large indigenous firms operating at the MERCOSUR level more than at the global level. However, deeper regional integration in Latin America will not gain momentum as long as the lobbying power of the commodity sector will be as important.

5. Mercosur weakened by rival liberalization and integration projects

43With 78.8% of their combined GDP in 201454 Brazil is the economic giant of Mercosur and will determine the future of industrial policy in South America as it holds the largest firms. More than Argentina which had embraced the neoliberal Washington Consensus for a whole decade under Menem, Brazil kept a defensive position to protect some of its national champions throughout the 1990s and 2000s. By addressing the issues of US agricultural subsidies and intellectual property, the Lula government managed to bring to a stalemate the FTAA negotiation at the Miami Summit of 2003 and to keep some room for manoeuvre to protect national champions in key industries while at the same time defending the agribusiness and not committing to an ambitious and costly industrial policy that could have alienated the commodities lobby. This defensive tactic was also used at the multilateral level during the Doha round with the help of India and other emerging economies to oppose the US and European agenda, notably on Singapore issues and agriculture protection.

44However, the US administration and the EU decided to develop bilateral talks to go round the opposition of large emerging countries. After the collapse of Cancun Robert Zoellick openly advocated for “competitive liberalisation” : “We’ll do bilateral (…). Bilaterals have been a very useful means of exerting influence”55. The strategy actually started before in 2002 with the US negotiating successfully preferential trade agreements with Central America and the Dominican Republic in 2002 (effective since 2009), with Chile in 2003 (effective since 2004), Peru in 2006 (effective since 2009), Columbia in 2006 (effective in 2012), Panama in 2007 (effective since 2012). The new left wing government of Correa in Ecuador ended the US agreement negotiated by its predecessor. The European Union followed to avoid trade diversion in favour of the US and developed preferential trade agreements with Mexico, all the countries of Central America, Dominican Republic, Colombia, Guyana, Jamaica, Surinam, Chile, Peru and many of the island-states from the Caribbean. Japan developed FTAs with Mexico, Chile and Peru in the 2000s. Korea developed FTA with Peru, Colombia and Chile and is currently negotiating one with Mexico (Korea 2015). These agreements, especially the US ones, are deep agreements. The US ones cover most of the Singapore issues (public procurements, state aid, strengthening of TRIMs and TRIPs)56. In that sense the non-Mercosur Latin American economies have opened more to the most advanced economies than to many of their Latin American trade partners.

45The Pacific alliance that includes Chile, Mexico, Peru and Columbia (with Costa Rica engaged in negotiation to join since 2014) is composed of countries that all have developed deep preferential agreements with the US and other industrialized partners. Its member states all accepted since the 1980s a specialization in commodities and a technological dependency upon more advanced economies which hosts R&D marshallian districts. The open aim of the alliance is to refocus its economy towards the Pacific and trading more with East Asian economies, strengthening a transpacific division of labour in which these countries would play the role of the commodities provider. Three of the four have agreed on the content of the Trans-Pacific Partnership (TPP) negotiations and Colombia has expressed an interest in joining the TPP. Indeed figures show a trade of manufactured goods from Pacific Asia exchanged for commodities from Latin America with a trend that has not changed for a half a century. As they are already more open economies than Mercosur, the Pacific Alliance are developing a very ambitious and rapid reduction of tariffs and other liberalization on government procurements, financial services, TBT and rules of origins facilitations. Anecdotic evidence seems to show that business lobbies behind this Pacific Alliance do not favour the model of state intervention and active industrial policy57. The Pacific Alliance and Mercosur claims openly that they are not conflicting blocks58but they do represent different strategies of development and it is unlikely that the open economies of the Pacific Alliance would change their model for their Mercosur partners which have become far less important than their access to global markets.

46It seems that the perspective for a South American regional integration based on the regionalization of manufacturing sector constitutes a more remote possibility than ever. Are the Brazilian and Argentine governments willing to keep open their industrial policy options and refuse the Pacific Alliance Model as their economic crisis worsens? If they opt for a model closer to the Washington consensus like the Pacific Alliance, CAFTA+D or NAFTA, it is unlikely that Latin American champions in the manufacturing sectors will emerge, keeping the continent dependent on foreign technology and lacking indigenous firms engaged in the regionalization of their production process. It would then mean that Latin American integration processes would be based mostly on the integration of services and labour rather than manufacturing. Other regional integration processes such as the EU, NAFTA or ASEAN have shown that these last two types of integration (service and labour) have to overcome greater barriers and generate much more tensions that insuring the free movements of goods within their region. These tensions have usually been contained by the strong lobbies of the enterprises willing to support economic regionalization but these types of lobbies are much weaker in South America compared to commodity lobbies. Such an evolution could leave South America a region less integrated than other de jure or de facto regional integration processes involving the US, Europe or Japan and their MNEs. The difficulties of Mercosur clearly highlight the limits of a south-south integration scheme without industrial policy that can generate a pressure for regionalization that overcome national protectionist barriers. It does not mean that Mercosur cannot continue to exist as a limited integrated regional market, an intergovernmental forum or a regional political group of countries. However, in the current level of integration, it will not constitute a major institutional actor outside the region.

Conclusion

47This article has identified the main structural economic weaknesses of Mercosur as a regional integration process. It has shown that as Mercosur is composed of developing countries in a period characterized by a high degree of volatility regarding commodity prices and financial flows which means that they experience stronger and more frequently macroeconomic shocks than regional integration process between developed countries (such as the EU). These shocks have put serious strains on the economic cooperation between the Mercosur member states, notably Argentina and Brazil.

48It also underlined that, contrary to what the experiences of developing economies from East Asia, Central America or East Asia, the geographical location of Mercosur (remote from the major economic centres of the world economy), its topography and its bottlenecks in terms of transport infrastructure make the region relatively unattractive to FDI in export-oriented manufacturing activities. These characteristics have reinforced Latin America’s specialization in primary products in the 2000s. This “re-primarisation” has been strengthening the commodities’ lobbies that do not constitute in general a driving force behind regional integration. The commodities lobbies tend to accept the global division of labour in which Mercosur economies continue to play their traditional role of provider of commodities for industrialized countries, not only Europe and the US but increasingly East Asia, and notably China.

49This evolution generates a vicious cycle in which the relative weakening of the manufacturing sector slows down the underlying microeconomic forces driving regional economic integration and lowers the prospects of strong domestic consumption and economies of scale for local manufacturers.

50Finally, this article has also highlighted that the policies adopted by East Asian economies to break the path dependency to develop a strong manufacturing sector cannot simply be replicated by Mercosur member states, should they wish it given their totally different economic and geopolitical context. The pattern that has just been outlined generates serious challenges in terms of economic development for Latin America and for the Mercosur integration project.

Notes

1 Wilkins (M.), The Maturing of the Multinational Enterprise: American Business Abroad from 1914 to 1970, Cambridge, Harvard University Press, 1974.

2 Julien (C.), L’Empire Américain, Paris, Grasset, 1968 & Santander (S.), Le Régionalisme sud-américain, l’Union européenne et les Etats-Unis, Bruxelles, Editions de l’Université de Bruxelles, 2008.

3 Bulmer-Thomas (V.), The Economic History of Latin America since independence, Cambridge, Cambridge University Press, 2003.

4 Skidmore (T.), & Smith (P.), Modern Latin America, Oxford, Oxford University Press, 4th edition, 1997.

5 Nouillat (Y-H.), Les Etats-Unis et le Monde au XXème siècle, Paris, Armand Colin, 1997 ; Julien (C.), L’Empire Américain, Paris, Grasset, 1968

6 Santander (S.), Le Régionalisme sud-américain, l’Union européenne et les Etats-Unis, Bruxelles, Editions de l’Université de Bruxelles, 2008.

7 Butler-Thomas (V.), The Economic History of Latin America since independence, Cambridge, Cambridge University Press, 2003.

8 Thual (F.), Géopolitique de l’Amérique Latine, Paris, Economica, 1996.

9 Defraigne (J-C.), ‘The Relevance of Europe’s Supranational Experience for other Regional Integration Processes: a Geopolitical and Economic Comparative Analysis from a Long-term Perspective’ in Franck (C.), Defraigne(J-C) & Demoriame (V.), The European Union and the Rise of Regionalism: Source of Inspiration and Active Promoter, Louvain-la-Neuve, Academia-Bruylant, 2009.

10 Stiglitz (J.) & Serra (N.), The Washington Consensus Reconsidered, Oxford, Oxford University Press, 2008; Chang (H-J.), Bad Samaritans, London, Random House Business Books, 2014.

11 Oman (C.), Globalisation and regionalisation, Paris, OCDE, 1994.

12 Rodrik(D.), The Globalization Paradox, Oxford, Oxford University Press, 2011; Krugman (P.), The return of Depression Economics, New-York, Norton, 2000.

13 EXTERNAL ACTION SERVICE OF THE EU, EU Relations with Mercosur, http://eeas.europa.eu/mercosur/index_en.htm, consulted on December 22nd 2015.

14 Adda (J.), La Mondialisation de l’Economie, Paris, La Découverte, 2006

15 Oman (C.), Globalisation and regionalisation, Paris, OCDE, 1994

16 Santander (S.), Le Régionalisme sud-américain, l’Union européenne et les Etats-Unis, Bruxelles, Editions de l’Université de Bruxelles, 2008.

17 IDB-INTAL, Highlights of Mercosur, Report n° 18, Buenos Aires, Inter-American Development Bank, 2013

18 Spalding (R.), Contesting Trade in Central America, Austin, University of Texas Press, 2014

19 Verhulst (G.), ‘Unbalanced triangle’ » inWouters (J.), Defraigne(J-C) & Burnay (M.), China, the EU and the Developing World, Cheltenham, Edward Elgar, 2015

20 Salama (P.), Les Economies Emergentes Latino-Américaines, Paris, Armand Colin Economie, 2012.

21 FORTUNE GLOBAL 500, http://fortune.com/global500/ consulted on 22nd December 2015

22 Butler (N.), ‘Venezuela: Reform Postponed’, London, Financial Times, April 19 2015

23 Dicken (P.), Global Shift: reshaping the global economic map in the 21st century, Sage publications, London, 2015

24 Thun (E.), ‘The Globalization of Production’ in Ravenhill (J.), Global Political Economy, Oxford, Oxford University Press, 2008, Defraigne(J-C), Introduction à l’Economie Européenne, Bruxelles, De Boeck Ouvertures Economiques, 2013

25 Dicken (P.), ‘Global Shift: reshaping the global economic map in the 21st century’, Sage publications, London, 2015

26 Salama (P.), Les Economies Emergentes Latino-Américaines, Paris, Armand Colin Economie, 2012 ; Silva Ramos Becard (D.), ‘O que Esperar das relacões Brasil-China?’, Revista de Sociologia e Política. vol.19 , supl.1, Curitiba, Nov. 2011.

27 Yamamura (K.) & Hatch (W.), Asia in Japan's embrace: building a regional production alliance, Cambridge, Cambridge University Press, 1997.

28 Heribert (D.) Ed, Report on East Asian Integration: Opportunities and Obstacles for Enhanced Economic Co-operation, Paris, Notre Europe, 2005.

29 Haber (S.), Klein (H.), Mauer (N.) & Middlebrook (K.), Mexico since 1980, Cambridge, Cambridge University Press; Dawson (A.), First World Dreams: Mexico since 1989, London, Zed Books, Mc Millan 2006; Bull (B.), Castellacci (F.). & Kasahara (Y.), Business groups and Transnational capitalism in Central America, Basingstoke,Palgrave Mc Millan, 2014, Spalding (R.), Contesting Trade in Central America, Austin, University of Texas Press, 2014

30 IMF, World Economic Outlook Database-October 2015,International Monetary Fund. Accessed on 15 October 2015.

31 Brainard(L.) & Martinez-Diaz (L.), Brazil as an economic superpower?, Washington DC, Brookings Institution Press, 2009.

32 Thery (H.), Le Brésil, Paris, Armand Colin Géographie, 2012 & Sharma (R.), Breakout Nations, New-York, Norton, 2012, Terra (C.) ‘Le Brésil : l’avenir est-il pour maintenant ?’ in CEPII, L’économie Mondiale 2013, Paris, La Découverte, 2012

33 Rouquie (A.), Le Mexique: un Etat-Nord Américain, Paris, Fayard, 2013 & Dawson (A.), First World Dreams: Mexico since 1989, London, Zed Books, Mc Millan 2006.

34 Bouissou (J-M.), Le Japon Contemporain, Paris, CERI, Fayard, 2007 ; De Koninck (R.), L’Asie du Sud-Est, Paris, Armand Colin Géographie, 2005, Lanzarotti (M.), La Corée du Sud: une Sortie du Sous-développement, Paris, IEDES & PUF, 1992.

35 Studwell (J.), How Asia Works ?, London, Profile Book, 2014; Jansen (M.)The Making of Modern Japan, Cambridge, Harvard University Press, 2000

36 Samuels (R.), Rich Nation Strong Army: National Security and the technological transformation of Japan, New York, Ithaca, 1994; Terry (E.), How Asia Got Rich: Japan, China and the Asian Miracle, New-York, Sharpe, 2004.

37 Komiya (R.) (ed.), The Japanese economy: trade, industry, and government, Tokyo, University of Tokyo Press, 1990.

38 Zhang Guang (S.), ‘The Sino-Soviet Alliance and the Cold War in Asia, 1954-1962’ in The Cambridge History of the Cold War, Vol II, Cambridge, Cambridge University Press, 2014.

39 Teiwes (F.), ‘Establishment and consolidation of the Regime’ in The Cambridge History of China, volume 14, Cambridge, Cambridge University Press, 1989

40 Naughton (B.), The Chinese Economy: transition and growth, Cambridge, MIT Press, 2007.

41 Gripouloux (F.), La Chine du 21ème siècle: une nouvelle superpuissance?, Paris, Armand Colin, 2006 & Huang (Y.), Capitalism with Chinese characteristics : entrepreneurship and the state, Cambridge, Cambridge University Press, 2008.

42 Skidmore (T.), & Smith (P.), Modern Latin America, Oxford, Oxford University Press, 4th edition , 1997.

43 Julien (C.), L’Empire Américain, Paris, Grasset, 1968

44 Kane (T.), Global US troops Deployment,1950–2003, Washington DC, Heritage Foundation, 2004

45 Julien (C.), Op.cit.,1968.

46 Galeano (E.), Open veins of Latin America, London, Serpent’s tail, 2009.

47 Niedergang (M.), Les 20 Amériques Latines, Paris, Seuil Point Politique, 1975 ; Julien (C.), Op.cit., 1968.

48 George (S.), A fate worse than debt, New-York, Grove Weidenfeld, 1990; Bulmer-Thomas (V.), The New economic Model in Latin America and its impact on distribution income and poverty, New-York, St Martin Press, 1996.

49 Narlikar (A.), The WTO: a very short introduction, Oxford, Oxford University Press, 2005; Zacharie (A.), Mondialisation: qui gagne et qui perd?, Brussels, Edition du bord de l’eau, 2013.

50 Terra (C.) ‘Le Brésil : l’avenir est-il pour maintenant ?’ in CEPII, L’économie Mondiale 2013, Paris, La Découverte, 2012, Gaulard (M.), L’économie du Brésil, Paris, Bréal, 2011; Compagnon (O.), Rebotier (J.) & Revet (S.), Le Venezuela au-delà du Mythe, Paris, Editions de l’Atelier, 2009, OECD

51 Krugman (P.), Strategic Trade Policy and the New International Economics, Cambridge, MIT Press, 1993.

52 Franck (C.), Defraigne (J-C.) & Demoriame (V.), Op.cit.

53 Nesadurai (H.), Globalisation, Domestic Politics and Regionalism: The ASEAN Free Trade Area, London, Routledge, 2003; Dinan (D.), Ever Closer Union : An introduction to European integration, London, Palgrave Mc Millan, 2005.

54 IMF, World Economic Outlook Database-October 2015,International Monetary Fund. Accessed on 15 October 2015.

55 Blustein (P.), Misadventures of the Most Favored Nations, New-York, Public Affairs, 2009.

56 Horn (H.) & Sapir (A.), ‘Beyond the WTO? An anatonomy of EU and US preferential trade agreements, Brussels’, Bruegel Blueprint n°7, 2009.

57 Mander (B), Mercosur views Pacific Alliance with unease, London, Financial Times April 1st 2014

58 “We must stop once and for all the prejudice that there are two opposing blocs that do not talk to each other," advocated Chilean President Michelle Bachelet, the main driving force behind this initiative. While "Mercosur and the Pacific Alliance uphold different economic models ... both bodies are important. The gradual and pragmatic convergence would provide significant benefits to the countries of each of these blocs” quoted from Navarez (A.) Mercosur and Pacific Alliance: Latin America Divided, Wolrdpress. Org, http://www.worldpress.org/article.cfm/Mercosur-and-Pacific-Alliance-Latin-America-Divided, consulted on 22th November 2015.