- Home

- volume 38 (2020)

- Numéro 3-4

- An ex-post evaluation of optimal credit granted to the youth under the program of Promoting Entrepreneurship in Agro-pastoral Activities in the Centre region of Cameroon

View(s): 2023 (2 ULiège)

Download(s): 0 (0 ULiège)

An ex-post evaluation of optimal credit granted to the youth under the program of Promoting Entrepreneurship in Agro-pastoral Activities in the Centre region of Cameroon

Résumé

Une évaluation ex-post du crédit optimal octroyé aux jeunes dans le cadre du Programme de Promotion de l’Entrepreneuriat Agropastoral dans la région du Centre au Cameroun

Cet article utilise la méthode d’évaluation ex-post en vue d’estimer le niveau optimal de financement externe qui maximiserait le bénéfice des jeunes entrepreneurs engagés dans les activités agro-pastorales du Programme de Promotion de l’Entrepreneuriat Agropastoral des Jeunes (PEA-Jeunes) dans la région du Centre au Cameroun. Le modèle de programmation linéaire (LP) suggère une contribution personnelle variant entre 238,510 et 995,000 FCFA pour chaque activité. Il recommande aussi l’utilisation de la totalité du crédit de démarrage/subventionné (1,200,000 FCFA) pour chaque activité, qui peut se justifier par son taux d’intérêt nul (0%) par rapport au crédit productif (15% du taux d’intérêt) dont l’utilisation (<1,500,000 FCFA) est recommandée uniquement pour les activités à court cycle (poulet, maïs) et non pour les activités à long cycle de production (porc, plantain, manioc). La restriction de rotation imposée au modèle de programmation donne des résultats similaires à ceux de la profitabilité en utilisant le taux de rentabilité économique et suggère la monoculture comme étant profitable pour seulement une activité (plantain), tandis que les quatre autres activités (maïs, porc, poulet, manioc) seraient profitables s’ils sont entrepris ensemble ou en association. Ainsi, le Programme PEA-Jeunes devrait penser au financement simultané de plusieurs activités, à accroître le montant du crédit subventionné pour les activités agro-pastorales à court cycle et revoir à la baisse le crédit productif ou même l’éliminer complètement pour les activités à long cycle de production.

Abstract

This study uses an ex-post evaluation method to estimate the optimal external funding level that maximizes the benefit of agro-pastoral enterprises supported by the youth program for the Promotion of Entrepreneurship in Agro-pastoral Activities (PEA-Youth Program) in the Centre region of Cameroon. The Linear Programming (LP) model recommends a personal contribution between 238,510 and 995,000 FCFA for each enterprise. It also recommends full use of start-up/subsidized credit (1,200,000 FCFA) for each activity, which can be justified by its zero interest rate (0%) as compared to the productive credit (15% interest rate) whose use(<1,500,000 FCFA) is recommended for short cycle activities (poultry, maize) and not recommended for long cycle activities (piggery, plantain, cassava production). The results of LP rotation restriction are similar to the profitability results using the economic rate of return (ERR) and suggest monoculture as profitable to only one activity (plantain), while the four remaining enterprises (maize, piggery, poultry, cassava) could be profitable if undertaken simultaneously or in association. Hence, the PEA-Youth Program should consider funding several activities at the same time, increasing the level of subsidized credit for short cycle agro-pastoral enterprises whereas productive credit should instead be revised downwards or eliminated completely for long cycle activities.

Table of content

Introduction

1In Cameroon like most African countries, population growth is on the increase and this is creating pressure on job offer that fails to meet the demand, hence unemployment rate remains high (about 75.8%) (1). The promotion of youth entrepreneurship appears as a solution to create and multiply jobs, particularly in the agricultural sector that is capable of absorbing a significant work force. The pace of growth of the population compared to domestic production, is a real challenge in terms of unemployment and inadequate agricultural supply. For this purpose, youth entrepreneurship in agriculture is encouraged and especially the creation of jobs for youth particularly in the pastoral sector. Young people, who represent 78% of Cameroon's population, are a huge labour potential which unfortunately the economic system fails to absorb (4, 12). The inability of the Government and the private sector to meet the expectations of the population, especially the youth in terms of jobs is likely to cause political and social instability.

2Cameroon in its strategy paper for growth and employment (GESP), is resolutely committed to a policy of promoting self-employment and wealth creation in order to promote the emergence of viable agribusinesses, creating jobs and reducing the unemployment rate and the level of poverty. For this purpose, one of the objectives of the GESP is to reduce unemployment from the current rate of 75.8% to less than 50% by the year 2020 with the creation of tens of thousands of formal jobs per year in the next decade (1). This strategy is of particular importance to the agricultural sector where niches of unexplored opportunities exist. It is also within this context that the Republic of Cameroon and the International Fund for Agricultural Development (IFAD) have jointly signed in February 2015 the agreement for funding the program for the Promotion of Entrepreneurship in Agropastoral Activities (PEA) for the Youth.

3In this view, the Promotion of Entrepreneurship in Agropastoral (PEA) Activities - Youth Program is intended to support the development of profitable businesses undertaken by young men and women aged between 18 to 35, integrated in the viable value chains of agropastoral systems and offering job opportunities in rural areas. Launched in Cameroon since 2015, this program is already installed in four regions of the country (Centre, Littoral, South and North West). The commodities of interest funded by the program are: crop production activities including pineapple, maize, plantain, pepper, market gardening, cassava; and those of animal production, in the case of pork, small ruminants, modern and/or traditional poultry as well as non conventional animal husbandry. Similarly, support for businesses take into account the entire value chain for each activity.

4Any enterprise accompanied by the PEA-Youth Program has the opportunity to be financed on a single activity at any given time, and this depends on the type of entrepreneurial activities. For this purpose, a company that is in the process of creation (start-up stage), is entitled to a ceiling of 3 million FCFA funding, then 10% of personal contribution (own capital)1, 40% of credit for start-up (subsidized credit by the State of Cameroon and IFAD) and 50% of productive credit from microfinance institutions. While an enterprise in the course of expansion is entitled to a ceiling of 10 million FCFA, then 20% of personal contribution (own capital), 30% of start-up credit (subsidized credit) and 50% of productive credit.

5In this financing scheme, we noticed that the support granted to enterprises does not consider the type of activities of the entrepreneur. However some entrepreneurs believe that the financing to be granted should be increased (even beyond the funding cap) in the cases of commodities like the piggery and poultry. Indeed, the maximum funding should differ from one activity to another, as well as the amounts of loans to meet the needs of different types of business enterprises that are financed. According to the Program of the United Nations for Development (15), production costs vary from one activity to another, and this reiterates the importance of adapting funding to the type of agropastoral activity. In the case of plant production, for example, costs of production per hectare of maize on average approach 1,342,500 FCFA (equivalent of about US $2,500). However one hectare of plantain requires on average a sum of 3,144,000 FCFA (equivalent of about US $6,000) and a hectare of pineapple requires about 4,000,700 FCFA (equivalent of about US $8,000) (10). In the case of animal production, we need an average 4,933,500 FCFA (equivalent of about US $10,000) to launch a band of 500 broilers, or need approximately 11,804,000 FCFA (equivalent of about US $23,000) for the production of pigs then 10 sows, 1 boar (12, 14).

6This mismatch could put to question the viability of enterprises supported by the PEA-Youth Program, by influencing negatively their current and future performance. To some extent this could explain why businesses created in Cameroon are characterized by a very low life expectancy, generally not exceeding five years (8). Beyond the above mismatch, the problem of external financing would be a major obstacle for nearly half of African enterprises (10).

7The existing literature on youth employment support programs (7, 9, 17) contend that the youth faced numerous obstacles and constraints that inhibit and undermine commercial viability of agribusiness enterprises. Key among these include lack of access to land, skills and knowledge to improve production efficiency, start-up finances and funds for expansion and the acquisition of new technologies and other support services. Most governments in sub-Saharan Africa have increasingly recognized productive entrepreneurship to be an important driver of economic development through fostering growth, job creation, technology adoption and innovation as well as poverty alleviation. In this vein, most governments with the assistance of development partners are supporting youth enterpreneurship programs (the case of PEA-Youth Program in Cameroon) to achieve growth and development objectives. For the majority of unemployed youths in Sub-Saharan Africa, productive entrepreneurship offers not only an opportunity to build sustainable livelihoods, but also a chance for integrating themselves into the global economy. A good understanding of the opportunities and constraints to youth entrepreneurship in different settings is thus critical for driving and successfully implementing this policy agenda.

8Empirical evidence from youth employment support programs (5) indicates that participation in the youth fund program is positively and significantly influenced by the age cohort of the youth entrepreneur (the older youth aged 26-35 years are more likely to access the fund compared to the younger youth of 18-25 years), location of the business (urban based businesses have a higher chance of accessing the fund), type of business enterprise (those in services are more likely to access the fund loan) and business maturity. Although there has been some positive effect of the fund on business expansion, we do not find significant evidence of the youth fund effect on jobs creation. Despite the importance assigned to entrepreneurship and youth in national development strategies, systematic research on the topic, especially in Africa, has been limited. In turn, the lack of accurate evidence on factors fostering and hindering youth entrepreneurship has impeded formulating effective, evidence-based policies to help address the youth employment challenge (14, 17). This study is, therefore, designed to close this knowledge gap by providing relevant evidence to assist policy makers design appropriate policies to tackle youth unemployment challenges.

9Hence, this paper intends to conduct an ex-post evaluation of the PEA-Youth Program in order to determine if the startup and credits granted (amounts of subsidized and productive credits needed for financing these enterprises) were optimal and to estimate the current profit earned by agro-pastoral enterprises supported by the PEA-Youth Program, in order to rank them in terms of profitability. In this vein, the general objective of the study is to estimate the optimal external funding level that maximizes the benefit of agro-pastoral enterprises supported by the PEA-Youth Program by type of agricultural activity. More specifically, the study estimates the profit levels of all agricultural and pastoral enterprises in order to classify these commodities in order of profitability. The study is realized under the hypothesis that: “financial support by the PEA-Youth Program remains below the credit needs expressed by the beneficiaries for their financing activities”.

Materials and methods

Study area and data collection

10The field survey was carried out from 1st February to 30th June 2017 in the Centre region of Cameroon. The choice of the Centre region is based on the representativeness of sampled population compared to other zones where PEA-Youth Program is implemented (12). Indeed, 300 entrepreneurs have been funded in four areas of action of the PEA-Youth Program (Centre, Littoral, South and North West), of whom 146 (or 48.67%) are located in the Centre region.

11The Centre region has six production areas according to the support mechanism of the PEA-Youth Program. Out of the six production areas/basins, this study selected three basins due to their strong representation of agro-pastoral companies. Indeed, of the 146 enterprises supported in the area of the Centre region, 80 (or 54.79%) of them are located in the three selected basins [basin 2 (Mfou, Soa and Edzendouang), basin 4 (outskirts of Yaoundé 6 and 7) and basin 5 (Obala, Batchenga, Mbandjock, Elig-Mfomo and Monatele)].

12The study population is made up of entrepreneurs from the first cohort (2015 cohort) and of the second cohort (2016 cohort) who benefited from the financial support of the PEA-Youth Program (12). Among them, only contractors involved in the process of creating enterprises were investigated, in order to simplify the modeling of the problem of this study. The unit of study is “agro-pastoral enterprises” in three selected areas/basins in which were surveyed 13 out of 43 poultry enterprises, 3 out of 17 piggery enterprises, 1 out of 3 cassava enterprises, 4 out of 5 plantain enterprises, and 10 out of 12 maize enterprises. This makes a total of 31 surveyed agro-pastoral enterprises out of the 80 existing ones (38.75%) throughout the whole study area.

Data analysis

13To address the research questions posed, the study uses a combination of approaches comprised of profitability analysis and Linear Programming (LP) technique.

Profitability analysis

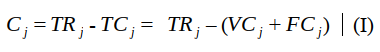

14The profit computation is made primarily on the basis of business plans of agro-pastoral activities of entrepreneurs. In fact, the profit of each agro-pastoral activity is the difference between total revenue earned and total costs spent by producing that activity. The profit of each agro-pastoral activity is thus formulated by Equation I such as:

Where: C = Profit for a single activity, TR = Total Revenue, TC= Total Costs, VC = Variable Costs, FC=Fixed Costs, the indices j are activities = chicken, pig, plantain, cassava, maize.

Where: C = Profit for a single activity, TR = Total Revenue, TC= Total Costs, VC = Variable Costs, FC=Fixed Costs, the indices j are activities = chicken, pig, plantain, cassava, maize.

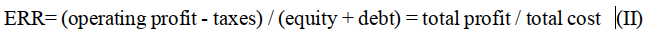

15In economics, assessing profitability is highly recommended to gauge the performance of enterprises. Generally, economic analysis distinguishes two types of profitability: financial and economic. The calculation of financial profitability takes into account equity (in mobilized funds). It allows us to understand the ability to make a profit on own capital provided by the shareholders. Conversely, the calculation of economic profitability is intended for all investors because it integrates all of the financial debt of the company and equity (in mobilized funds). This is the reason why in this study, the choice is on the economic profitability of the agro-pastoral enterprises. In light with this choice, this study computes the Economic Rate of Return (ERR) by using Equation II such as:

Linear programming technique

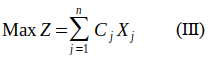

16With respect to the determination of the optimal credit by commodity, the study resorted to design a Linear Programming (LP) model for the implementation of all activities according to the various commodities. According to Hazell & Norton (6), a Linear Programming problem aims to maximize an objective function (Equation III) subject to constraints (Equation IV) such as:

17Objective function:

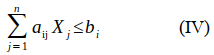

18Subject to constraints:

19Where: Xj = level of the jth agropastoral activity; Cj = profit of a unit of the jth agropastoral activity; aij = quantity of the ith resource to produce one unit of the jth activity; bi = amount of ith resource available; n =5 activities which are chicken, pig, plantain, cassava, maize; Z=total profit aggregated from the five agro-pastoral activities produced by the entrepreneur; j=activity, i=resource.

20The resources used in the model are classified in three groups to facilitate the presentation of the analysis of the results. This concerns resources related to the agro-pastoral activities, resources related to financing of enterprises and resources related to the rotation of agro-pastoral activities. The resources related to agro-pastoral activities take into consideration the density of chicken farms, the feed of chickens, the density of the piggery farms, the availability of land for crop production activities (plantain, cassava, maize), the availability of labour for all the activities, the density of cassava cuttings and the density of planting distance for maize. The resources related to the financing of enterprises are: own capital, productive credit and subsidized credit. The last group of resources is related to the rotation of agro-pastoral activities (chicken, pig, plantain, cassava, maize) according to the support policy of PEA-Youth Program which states that only a single activity should be financed at a given time.

21In this study, the LP model data come from the information of the business plan of the projects of entrepreneurs, the accounts of the agronomist, local agronomic bulletins (e.g. “Voix du Paysan”) with the technical and financial development repository of micro-projects. The collected data were subsequently integrated into the GAMS (General Algebric Modeling System) software for resolution.

Results and discussions

Economic profitability of enterprises

22The enterprises benefiting from the PEA-Youth Program include: breeding of broilers, swine breeding, production of plantain, cassava and maize. The descriptive statistics of profit recorded for each type of enterprise are presented in Table 1.

Table 1: Descriptive statistics of profit (FCFA per cycle of production) recorded

for the different agro-pastoral enterprises

|

Agro-pastoral activities |

N |

Minimum |

Maximum |

Mean |

Standard deviation |

|

Broiler chicken |

13 |

60,522 |

1,132,438 |

471,237 |

280,973 |

|

Piggery |

3 |

740,184 |

2,666,093 |

1,449,109 |

1,058,714 |

|

Plantain production |

4 |

353,393 |

1,086,293 |

579,889 |

340,059 |

|

Cassava Production |

1 |

2,929,917 |

2,929,917 |

2,929,917 |

0 |

|

Maize Production |

10 |

447,500 |

1,377,000 |

744,601 |

277,747 |

N= Number of respondents

23On the basis of costs invested and profits earned in each activity, the Economic Rate Return (ERR) was computed as illustrated in Table 2. According to the computed ERR of agro-pastoral enterprises, the most cost-effective activity is the production of cassava (357.27%), followed by production of plantain (101.54%), and then the maize crop (74.06%), and subsequently by piggery (66.85%) and finally by raising chickens (29.32%). This result indicates that farming is more profitable than pastoral activities (Table 2). The satisfactory performance observed in agricultural activities could be due to certain factors such as the good soil quality (especially fertility) and favourable weather conditions in the study area. While for pastoral activities, the health risks are very high and require a permanent availability of the employees for the supply and maintenance of animals (12).

Table 2: Economic rate of return (ERR) computed from the profit and cost values of agro-pastoral activities

|

Agro-pastoral activities |

Cost (FCFA) |

Profit (FCFA) |

ERR |

|

|

Value (%) |

Rank |

|||

|

Broiler chicken |

1,607,072 |

471,237 |

29.32% |

5th |

|

Piggery enterprise |

2,167,558 |

1,449,109 |

66.85% |

4th |

|

Plantain production |

571,111 |

579,889 |

101.54% |

2nd |

|

Cassava production |

820,083 |

2,929,917 |

357.27% |

1st |

|

Maize production |

1,005,399 |

744,601 |

74.06% |

3rd |

Optimal use of resources related to agro-pastoral activities

24The recommendations of the LP model in relation to optimal use of resources for agro-pastoral activities are illustrated in Table 3. Concerning the density for poultry farm, the total space is 560 m²; the model proposes to use 83 m². With regard to availability of feed for chickens, the model recommends to use all i.e. 3,726 kg. With regard to density of piggery farm, the total space available is 219 m², and the model proposes to use all. With regard to the availability of the surface area for the plantain production, the available space stands at 1,600 m²; the model recommends to use only 867 m². Out of the 4 ha of available land for agricultural production (plantain, cassava and maize enterprises), the model proposes to use 2.25 ha. Concerning the availability of labour, the total quantity available is 1,990 mandays and the model recommends to use 1,304 mandays. With regards to the density of planting the cassava cuttings, the quantity available is 2,500 cuttings, and the model proposes to use all. Concerning the density of planting materials for maize, the total quantity available is 100,000 seedlings, and the model proposes to use all (Table 3).

Table 3: Recommendations of the model and marginal productivities of resources related to agro-pastoral activities

|

Resources |

Maximum quantity available |

Recommended amount |

Marginal productivity |

|

Density of the chicken farm (m²) |

560 |

83 |

0 |

|

Feed for chickens (kg) |

3,726 |

3,726 |

428 |

|

Density of the pig farm (m²) |

219 |

219 |

2,872 |

|

Availability in plantain area (m²) |

1,600 |

867 |

0 |

|

Availability of land (ha) |

4 |

2.25 |

0 |

|

Availability of labour (manday) |

1,990 |

1,304 |

0 |

|

Density cassava cuttings (cuttings/ha) |

2,500 |

2,500 |

294 |

|

Density of maize seedlings (maize/ha feet) |

100,000 |

100,000 |

12 |

25Table 3 shows that all the resources related to the agro-pastoral activities need to be used as suggested by the recommended LP model results. However resources whose marginal productivities are greater than zero (including feed of chickens, the density of breeding pigs, the density of the cassava cuttings and the density of seedlings of corn), the enterprise is expected to increase their use in its activities if it has the opportunity to further increase its level of profit per production cycle. But for those whose marginal productivities are zero, the enterprise must scrupulously respect the quantities recommended by the model.

Own capital related to the financing of agro-pastoral enterprises

26Owned funds are very important in the eyes of investors and funding agencies. The level of personal contribution is notably considered by banks to determine the company’s borrowing capacity. In general, any entrepreneur looking forward to request for credit from a financial institution, must always submit a personal contribution, reflecting his level of commitment in its activity. As part of this work, the personal contribution is still considered to own capital.

27Own capital incurred by the enterprise varies according to the type of agro-pastoral activity including activity of the chicken farm, the breeding of pigs, the plantain production, cultivation of cassava and maize. The LP model recommendations for own capital to be used for each activity are illustrated in Table 4.

Table 4: Recommendations of the model and marginal productivity of own capital

|

Resources |

Maximum amount available (FCFA) |

Recommended amount (FCFA) |

Marginal productivity |

|

Capital for poultry |

300,000 |

300,000 |

0.15 |

|

Capital for piggery |

300,000 |

-362,900 |

0 |

|

Capital for plantain |

300,000 |

238,510 |

0 |

|

Capital for cassava |

300,000 |

-995,000 |

0 |

|

Capital for maize |

300,000 |

300,000 |

0.15 |

28In general, each activity has a ceiling of own capital estimated at 300,000 FCFA (Table 4). For two activities (including the breeding of pigs and the cultivation of cassava), the LP model recommends getting into debt, according to the "negative" sign in Table 4. This could be due to the fact that the financial structure of the enterprises in the PEA-Youth Program, is subdivided in three; including the personal contribution (own capital), subsidized credit (start-up credit) and productive credit sources. Furthermore, the model recommends higher levels of capital (higher than the limit of own capital available) to finance the breeding of chickens and the cultivation of maize (whose marginal productivities are greater than zero i.e. 0.15), which can be explained by the fact that these speculations have a higher cost per unit of production.

29Table 4 shows that the LP model recommends a level of specific personal contribution for each activity. This indicates the importance of the contribution to the entrepreneur in his own business, thus strengthening its credibility with potential donors and funding institutions. This idea is particularly supported by Fauré (2) by stating that among formal and informal financing practices, own capital (personal contribution) of the entrepreneur is by far the primary source of constitution of the initial capital.

Credit granted to agro-pastoral enterprises

30The credit is an essential part in the financing of companies looking for alternative ways to increase their capital. In the PEA-Youth Program, businesses benefit from two types of credit: subsidized credit (start-up credit or credit to boot) and productive credit. Table 5 presents the amount of subsidized (start-up credit) and productive credit for each activity.

Table 5: Recommendations of the model and marginal productivity of subsidized credit (start-up credit) and productive credit

|

Resources |

Maximum amount available (FCFA) |

Recommended amount (FCFA) |

Marginal productivity |

|

Subsidized credit (start-up credit) |

|||

|

Subsidized credit for poultry |

1,200,000 |

1,200,000 |

0.15 |

|

Subsidized credit for piggery |

1,200,000 |

1,200,000 |

EPS |

|

Subsidized credit for plantain |

1,200,000 |

1,200,000 |

EPS |

|

Subsidized credit for cassava |

1,200,000 |

1,200,000 |

EPS |

|

Subsidized credit for maize |

1,200,000 |

1,200,000 |

0.15 |

|

Productive credit |

|||

|

Productive credit for poultry |

1,500,000 |

106,180 |

0 |

|

Productive credit for piggery |

1,500,000 |

0 |

0 |

|

Productive credit for plantain |

1,500,000 |

0 |

0 |

|

Productive credit for cassava |

1,500,000 |

0 |

0 |

|

Productive credit for maize |

1,500,000 |

510,800 |

0 |

Note: EPS = not zero, but close to zero

31Concerning the use of subsidized credit (start-up credit), the LP model recommends its full use (exhaustion) for all agro-pastoral activities (1,200,000 FCFA). The model even suggests to increase the available subsidized credit for short cycles enterprises including the breeding of chickens and maize (whose marginal productivity is 0.15), in order to increase the profit of the contractor. As the goal of any business is to maximize its profit, the use of large amounts of subsidized credit seems more rational for these two activities. Our findings are similar to the result of a study conducted by Fauré (2) in Ivory Coast which revealed that almost 90% of credits granted lies between 500,000 and 1,000,000 FCFA, in addition to the personal contribution.

32The exhaustion of subsidized credit for all activities can be justified by its null interest rate (0%) as compared to the 15% interest rate of productive credit whose use is recommended for long cycle activities (pork, plantain, cassava). Thus, this financial structure was arbitrated on the basis of the costs of the debt. This logic is also supported by Sakina et al. (13) who claim that the search for an optimal financial structure led to focus on “less expensive financing methods”. Overall, the full use of subsidized credit such as recommended by the LP model will increase equity of the promoters of agro-pastoral enterprises. In this view, Wampfler (16) demonstrated that access to these credits will allow entrepreneurs to break the vicious circle of poverty in which they lived (leading to increased their production), thus leaving room for the virtuous circle.

33With regards to productive credit, the maximum available amount per activity is 1,500,000 FCFA. However, it is apparent from the foregoing analysis of the model as presented in Table 5 that the productive credit should not be used in the financing of agro-pastoral enterprises, especially for pigs breeding, the production of plantain and cassava cultivation. This could be due to the cost of the credit (which the interest rate is 15%) that could make the potentially dependent contractor from the outside by reducing its margin of autonomy and decision making. In addition, other enterprises require the use of productive credit, particularly in the production of chickens and maize. This could be due to the fact that these two activities are those with shorter production cycles. Therefore for these two activities, the interest paid on the productive credit is less important than other enterprises because deadlines for refund will be faster depending on the periods of deferred. This result is supported by Kay (10) who showed in his study that nearly half of African firms consider access to external financing and its cost as a major obstacle to their activities. It is also supported by another research by Feudjo et al. (3), who think that as businesses grow, they need additional capital and must turn to external sources. This shows that no use of productive credit could also be due to the character "emerging" of these companies (as they are still very little developed) on the one hand, but also to the cost of credit whose amount would be mainly linked to the duration of the cycle of production.

34The recommendations of the model show that the research hypothesis stating “financial support by the PEA-Youth Program remains below the credit needs expressed by the beneficiaries for their financing activities” is rejected. Indeed, the results of the model show that the amount of productive credit to be granted to the entrepreneur should instead be revised downwards, and even in some cases to be eliminated completely. In the light of the forgone, therefore, this research hypothesis is rejected.

Results arising from the rotation of the agro-pastoral activities

35A diversity of agro-pastoral speculation is performed by systems operators, particularly in developing countries. These activities can be done simultaneously or alternately based on farming practices. But according to the support policy of the PEA-Youth Program, the implementation of a speculation automatically excludes others i.e. only a single activity should be financed at a given time. In this logic, the use of the modeling approach is based on the restriction of rotation. According to the approach of rotation used, the same activity will be implemented only when its turn in the sequence will happen (6). Table 6 presents the recommendations of the LP model from the rotation restriction of each agro-pastoral activity.

Table 6: Recommendations of the model from the rotation restriction imposed to agro-pastoral activities

|

Resources |

Maximum level |

Recommended level |

Marginal productivity |

|

Rotation poultry |

0 |

-78 |

0 |

|

Rotation piggery |

0 |

-1,661 |

0 |

|

Rotation plantain |

0 |

0 |

1,674 |

|

Rotation cassava |

0 |

-1,733 |

0 |

|

Rotation maize |

0 |

-1,730 |

0 |

36From Table 6, the enterprise loses 78 FCFA by only doing the breeding of broilers at the expense of other activities (pig, plantain, cassava, maize). In the same manner, the enterprise loses 1,661 FCFA only by concentrating on the piggery farming at the expense of other activities (chicken, plantain, cassava, maize). Using the same analogy, the enterprise loses 1,733 FCFA by concentrating only on cassava production at the expense of other activities (chicken, pig, plantain, maize) and equally loses 1,730 FCFA by concentrating on maize production at the expense of other activities (chicken, pig, plantain, cassava). However, the LP model recommends plantain production in monoculture and by doing this, the enterprise gains 1,674 FCFA (the model displays the value of zero when plantain is grown in rotation thereby disagreeing with any decision to adopt rotation method for this crop).

37According to these results, except for plantain, monoculture is not profitable in the four remaining activities which would become profitable only if grown simultaneously or in association with other activities. In this respect, we recommend the PEA-Youth Program to review its support policy by funding several enterprises at the same time (and not only one enterprise at a time as currently done).

38From the analysis, it is clear that the constraint of restriction of activity is based on the opportunity cost approach, which illustrates the cost of the sacrificed or forgone alternative. However, under the current PEA-Youth Program support policy, the results indicate that monoculture is more profitable for producing plantain which leads to the lowest opportunity cost (0 FCFA), followed in order by broilers breeding (78 FCFA), then by piggery (1,661 FCFA), then by maize crop (1,730 FCFA), and lastly by cassava cultivation (1,733 FCFA) (Table 6). This ranking is nearly similar to the classification that has been obtained based on the economic rate of return (ERR) in Table 2. These results confirm the assertion of Yammine (18) that the opportunity cost is a tool to validate, ex-post, the correctness or validity of a choice. Based on the classification of activities according to the ERR and the opportunity costs, this study confirms the hypothesis that pastoral enterprises are more profitable compared to agricultural enterprises.

Conclusions and policy implications

Conclusions

39This study uses an ex-post evaluation method to estimate the optimal external funding level that maximizes the benefit of agro-pastoral enterprises supported by the PEA-Youth Program by type of agricultural activity in the Centre region of Cameroon. The analysis indicates that three different mechanisms exist for financing PEA-Youth enterprises, namely own capital, start-up credit (subsidized credit) and productive credit.

40The linear programming (LP) model constructed in this study serves as a tool for decision making with regards the level of credit for each commodity. This model has been used to evaluate the impact of increasing productive or subsidized credit for each agro-pastoral activity on the level of profit of the enterprise, according to different scenarios. In general, each activity has a ceiling/limit of own capital estimated at 300,000 FCFA but the model strongly recommends the use of own capital for some specific enterprises. Concerning the use of subsidized credit (start-up credit), the model recommends its full use for all agro-pastoral activities (1,200,000 FCFA). With regards to productive credit, the maximum available amount per activity is 1,500,000 FCFA but the model discourages the use of productive credit in the financing of long-cycle enterprises.

Policy implications

41This study demonstrated that, own capital (savings, family assistance) is crucial in financing the PEA-Youth Program and this source of financing should be promoted for sustainability in funding youth enterprises.

42In order to encourage youth engagement in agriculture, the PEA-Youth Program should step up the level of start up capital. The PEA-Youth Program should revise upwards the level of credit for start up (subsidized credit) for pastoral enterprises which require substantial investments.

43The PEA-Youth Program needs to work more effectively together with beneficiary agro-pastoral enterprises to evaluate and identify credit needs (productive and subsidized) according to the specificities of each type of enterprise. This will assist the enterprises to operate at optimum levels for increased profitability of the different agro-pastoral enterprises.

44The PEA-Youth Program should set up a performance monitoring and evaluation mechanism with clearly defined key performance indicators so that progress should be measured at mid-line and end-line against these set targets to ensure profitability of the agro-pastoral enterprises. This means that the PEA-Youth Program should monitor the use of start-up funds and other investments and provide adequate advices for the successful implementation of especially long cycle agro-pastoral enterprises.

Acknowledgements

45The authors are grateful to the PEA-Youth Program in the Centre region of Cameroon for granting an internship to the second author, which helped to collect data for the study. They also thank the anonymous reviewers for their constructive criticism, which helped to significantly improve this paper.

Bibliography

-

DSCE (Document de Stratégie pour la Croissance et l’Emploi), 2009, Ministère de l’Economie, de Planification et de l’Aménagement du Territoire. Yaoundé, Cameroun.

-

Fauré Y.A., 1992, Financement de la petite et moyenne entreprise à Toumodi (Côte d'Ivoire) : l'illusion informelle. Revue internationale P.M.E. : économie et gestion de la petite et moyenne entreprise, 5 (3-4) : 61-88.

-

Feudjo J.R. & Tchankam J.P., 2012, Les déterminants de la structure financière : Comment expliquer le paradoxe de l’insolvabilité et de l’endettement des PMI au Cameroun ? Revue internationale P.M.E : économie et gestion de la petite et moyenne entreprise, 25 (2): 99-128.

-

FIDA (Fonds International de Développement Agricole), 2013, Programme de Promotion de l’Entrepreneuriat Agropastoral des Jeunes (PEA-Jeunes) : Document de Conception. Cameroun.

-

Gemma A. & Kasirye I., 2015, Creating youth employment through entrepreneurship financing: the Uganda youth venture capital fund. Research Series No. 122.

-

Hazell, P.B. & Norton R.D, 1986, Mathematical programming for economic analysis in agriculture. Macmillan Publishing Company. New York, USA.

-

ILO, 2006, Stimulating youth entrepreneurship: barriers and incentives to enterprise start-ups by young people. Series on Youth and Entrepreneurship SEED Working Paper No. 76.

-

INS (Institut National de la Statistique), 2016, Caractéristiques de la population. Annuaire Statistique du Cameroun. pp. 72-89.

-

Janneke P., 2013, Youth employment in developing Countries. IZA Research Report, No. 58.

-

Kay. O.A, 2010, Contraintes de financement des PME en Afrique: le rôle des registres de crédit. Thèse de Doctorat (Ph.D). Institut d’économie appliquée. Montréal Québec, Canada. pp. 1-250.

-

Myers S. C. & Majluf N.S., 1984, Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics 13: 187-221.

-

Nju’pue N.P.N., 2017, Optimisation de l’offre de crédit dans le financement des activités agro-pastorales des entreprises bénéficiaires du programme PEA-Jeunes dans la région du Centre, Cameroun. Mémoire de Fin d’Etudes en vue de l’obtention du diplôme d’Ingénieur Agronome (Option: Economie et Sociologie Rurales). Département d’Economie Rurale, Faculté d’Agronomie et des Sciences Agricoles, Université de Dschang, Cameroun, 142 pp.

-

Sakina E.O. & Slimane E.D., 2014, Financement des coopératives agricoles marocaines, structure et performance. Laboratoire de Rechercher en Entrepreneuriat, Finance et Audit (LaREFA). Ecole Nationale de Commerce et de Gestion, Université Ibn Zohr, Agadir-Maroc.

-

UN (United Nations), 2013, Opportunities and Constraints to Youth entrepreneurship: Perspectives of Young Entrepreneurs in Swaziland. Mbabane, Swaziland.

-

UNDP (Programme des Nations Unies pour le Développement), 2010, Référentiel technico-financier de développement des microprojets: Activités génératrices de revenus. Yaoundé, Cameroun. pp. 1-169.

-

Wampfler B., 2016, Pourquoi est-il si difficile de financer l’agriculture familiale? Grain De Sel 72 : 6-8.

-

World Bank, 2012, Youth employment programs: an evaluation of World Bank and IFC support. World Bank, Washington DC, USA.

-

Yammine J., 2011, Coût d’opportunité de la guerre : application au cas du Liban. Thèse de doctorat en Sciences Economiques. Université Panthéon-Assas. Paris, France. pp. 17-23.

Notes

1 Personal contribution=own capital; Start-up credit=subsidized credit (at 0% interest rate); Productive credit (at 15% interest rate).

To cite this article

About: Achille Jean Jaza FolefacK

Cameroonian, Doctor (Ph.D.) in Agricultural Economics, Associate Professor, Department of Agricultural Economics, University of Dschang, Cameroon. E-mail: ajazafol@yahoo.fr

About: Patricia Nadège Nju’pue Ngapana

Cameroonian, Professional Master/Engineer in Agricultural Economics, Department of Agricultural Economics, University of Dschang, Cameroon. E-mail: ngapanapatricia@yahoo.fr

About: George Achu Muluh

Cameroonian, Doctor (Ph.D.) in Agricultural Economics, Senior Lecturer, Faculty of Economics and Management, University of Dschang, Cameroon.E-mail: magachuo@yahoo.com