Socio-Economic Factors and Smallholder Cassava Farmers' Access to Credit in South-Western Nigeria

Received on 10.07.15 and accepted for publication on 06.08.18

Résumé

Facteurs socio-économiques et accès au crédit des petits producteurs de manioc dans le sud-ouest du Nigeria.

L'accès au crédit est un facteur important dans la réalisation de l'augmentation de la productivité agricole. Nous avons adopté un modèle Tobit pour évaluer les facteurs qui influencent l’intensité de l'accès au crédit du petit producteur de manioc du sud-Ouest du Nigeria, en utilisant des données primaires collectées lors d’une enquête portant sur 856 ménages ruraux conduite par l'Institut international d'agriculture tropicale (IITA) en 2011. Les résultats, du modèle empirique, Tobit, indiquent que seules sept des 11 variables incluses dans le modèle ont une influence statistiquement différente de zéro sur l'intensité de l'accès au crédit. Cependant, seules les variables du cheptel, de la production totale de manioc, de la valeur monétaire des actifs productifs du ménage, de l'âge du chef de ménage, et de la taille du ménage, ont une influence positive et statistiquement différente de zéro sur l’intensité de l’accès au crédit. L'implication de ces résultats est que, l’augmentation de ces variables permettrait d'augmenter le montant du crédit auquel un agriculteur pourrait avoir accès. Par conséquent, les politiques qui mèneront à l'augmentation du nombre de têtes de bétail (cheptel), de la production de manioc et des actifs productifs des agriculteurs devraient être mises en œuvre.

Abstract

Access to credit is an important factor in the attainment of agricultural productivity increase. We adopted a Tobit model to assess the factors that influence the intensity of rural smallholder cassava farmers' access to credit in Southwest Nigeria, using primary data collected from 856 rural households by the International Institute of Tropical Agriculture (IITA) in 2011. The results of the empirical Tobit model indicate that seven out of the 11 variables included in the model are statistically related to the intensity of access to credit. However, only total livestock unit, cassava output, monetary value of the households' productive assets and household size are positively and statistically significant. This implies that increase in output, diversification of households' income sources into livestock production and accumulation of assets are important variables that have the potential to enhance farmers' access to larger amounts of credit. Therefore, policies that will lead to improve farmers' outputs and/or increase diversification and assets accumulation are recommended for this region.

Introduction

1Rural credit markets are essential for agricultural growth and development, particularly in the developing countries where the majority of producers are resource-poor rural dwellers. Poor access to credit by smallholder farmers who are the majority of the sector drivers is among the major constraining factors (7, 13, 33). The agriculture sector appears to be more credit dependent due to the seasonality of production and the need to move from subsistence to large-scale/commercial production. Although, access to agricultural finance can be viewed as only a mean to an end, it is highly very important and paramount to the attainment of nationally desired increase productivity, through having enough financial resources to adopt yield increasing agricultural technologies such as fertilizer, seed and improve post-harvest techniques (4, 24). For instance, Simtowe and Zeller (32) reported that credit access had a higher impact on the adoption of hybrid maize among credit constrained households in rural Malawi.

2In the same vein, Petrick (26) posits that lack of access to credit may affect farm productivity, based on the fact that many smallholder producers confronted with binding capital constraints would tend to use lower levels of inputs in their production activities. Furthermore, aaccess to credit can also increase farmers' resilience and adaptability in the face of the present global climate change and variability and thus, alleviating food insecurity and hunger. It can also enhances the production efficiency of small scale farmers, thereby reducing rural poverty and food insecurity (25). And can also assists the poor to smooth consumption and to build up assets greater than the value of the liability (15).

3In spite of the aforementioned significance of access to credit, Bali (6) reported that only 5 percent in African and about fifteen percent in Asia and Latin America have had access to formal credit due to lack of collateral. The agricultural sectors in many developing countries are also plagued with adverse issues such as low rainfall, poor soil fertility and inadequate infrastructure which make financial service providers categorize farmers as high risk clients who cannot use their farms as collateral for credit (12, 27). Additionally, in the likelihood effect of bad weather, entire producers' farm can be damaged or wiped out completely in a production season by droughts, floods, fire outbreak and insect pests. This constitute a source of high risk for lenders, because many farmers or producers will likely default. This is exacerbated by the fact that smallholder farmers often lived in widely dispersed communities resulting in high transaction cost in terms of credit administration and data gathering on the nature of their enterprises (27, 28). In view of this, financial service providers seldom extend credit services to smallholder farmers and even if they do farmers are often charged high interest rate

4A common feature of rural credit markets in developing countries is the coexistence of formal and informal credit markets (2, 8, 9, 8, 11, 12, 16). Ghate (14), defined formal financial service providers as registered companies that are licensed by a central monetary authority to offer financial services and further asserted that these institutions are largely urban based in terms of distribution of branches and the concentration of deposit and lending activities. According to Kashuliza et al. (18) informal financial services refer to all transactions, loans, and deposits that take place outside the regulated monetary system and this includes the activities of intermediaries such as relatives and friends, traders, and money lenders.

5Semi-formal institutions also exists and are described by Steel and Andah (32) as institutions which are registered to provide financial services and are not controlled by a central monetary authority. In Nigeria, Badiru (4) indicates that credit institutions are categorized into three groups:

-

formal, such as commercial banks, microfinance banks, the Nigeria Agricultural and Cooperative Rural Development Bank (NACRDB), and state government-owned credit institutions;

-

semi-formal, such as non-governmental organizations-microfinance institutions (NGO-MFIs) and cooperative societies; and

-

informal, such as money lenders, and rotating savings and credit associations (RoSCAs).

6Despite the aforementioned sources of credit, most farmers are still reportedly credit constrained. Lack of access or low access to credit has been reported in the literature as part of the factors militating against increased agricultural productivity and contributing to high rates of poverty among the rural smallholder farmers in developing countries. In spite of these facts, studies that have looked into the factors that influence rural farmers' access to credit are not many and those that actually assessed the determinants of intensity of access to credit; measured in this study as the amount of credit actually obtained by the farmers is scarce. This study therefore, contributes to the existing literature by examining those factors that influence the actual amount of credit obtained by rural smallholder farmers from formal or informal credit sources or both.

7In addition, most past studies that have looked into determinants of farmers' access to credit have treated access to credit as a binary variable (yes or no) neglecting the actual amount farmers obtained, which is the most important to attain any meaningful effect on rural livelihoods. Thus, the issue of farmers' access to credit is beyond the usually adopted methods such as Probit or Logit models which merely analyze whether a farmer has access to credit or not.

Materials and Method

Data Source and Sampling Framework

8This study was carried in the South Western geo-political zone of Nigeria. Ekiti, Osun, Ogun, Ondo, and Oyo were selected out of the six States in the south west. Smaller administrative units referred to as Local Government Areas (LGAs) were used as primary sampling units (PSUs). Enumeration areas (EAs), defined as a cluster of housing units, were used as secondary sampling units (SSUs). The final sampling units were the rural smallholder farming households. LGAs were selected from each State based on probability proportional to size, where size is measured as the number of EAs. The advantage of using EAs as sampling units is that each is approximately equal in population size. This ensured that all farmers had an equal probability of being selected, unlike the situation when sampling units are towns or villages of unequal size. Within each LGA, four EAs were selected at random from a sampling frame of EAs classified as rural or semi-urban, giving a total of 80 EAs or villages (as clusters of housing units, the EAs are similar to villages or communities).

9Finally, a list of households was developed for the selected EAs and a sample of at least 10 farming households was selected randomly in each of the sampled EAs, giving a total sample of 860 households. The survey was carried out between August and October 2011. Community and household questionnaires were administered by trained enumerators under the field supervision of a senior agricultural economist and the direction of IITA's economist. The data were collected using structured questionnaire. After data cleaning, about 856 (99.5%) of the questionnaires were useful for the analysis.

Analytical Framework and Estimation Techniques: The Tobit Model

10According to the International Financial Corporation (17), smallholders tend to be highly risk averse and are often unwilling to adopt new practices if the outcomes are uncertain or the benefits take time to manifest themselves. Studies indicate that only 5 to 10 percent of smallholders are willing to take risks, and 50 to 75 percent of smallholders are moderately to extremely risk-averse. Thus, farmers in traditional agriculture act economically rationally within the context of available resources and existing technology. Accordingly, poor farmers allocate resources in a manner consistent with the neo-classical profit maximization model. Thus, in the context of this study the cassava farmers' decision to access credit is based on the assumption of expected utility maximization. When confronted with a choice between whether to access credit or not, the smallholder cassava farmers would compare the expected utility of access to credit with non-access. The cassava farmers' decision to access credit is expected to be influenced by a set of household socioeconomic and demographic variables. Thus, famer J's expected utility of access and non-access to credit can be expressed in Equations I and II.

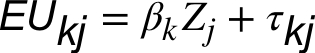

(I)

(I)

(II)

(II)

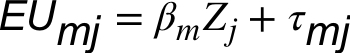

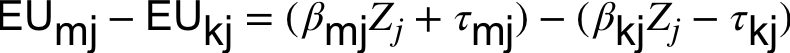

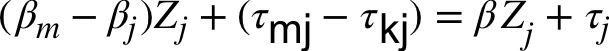

11Where EUkj and EUmj denote the expected utility with non-access and access to credit, respectively, and Z represents a set of the cassava farmer J's socioeconomic and demographic variables. τ is a random disturbance and assumed to be independently and identically distributed with mean zero. Then the difference in expected utility may be expressed in equation III.

=  (III)

(III)

If  , the cassava farmer will prefer to access credit. Thus, the difference of the expected utility between access and non-access to credit is the potential factor that influences the farmers' decisions.

, the cassava farmer will prefer to access credit. Thus, the difference of the expected utility between access and non-access to credit is the potential factor that influences the farmers' decisions.

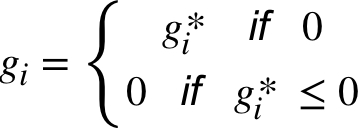

12The main objective of this study is beyond the determinants of access to credit to analyze the intensity of access to credit, therefore, we adopt the Tobit model. This is because the Tobit model which is an extension of the Probit model is useful for continuous values that are censored at or below zero as we have in this data set. When a variable is censored, regression models for truncated data provide inconsistent estimates of the parameters. The Tobit model assesses not only the probability of access to credit, but also the intensity or degree of access to credit measured by the total amount of credit obtained by the farmer for the production season under study in relation to the farmer's socioeconomic and demographic characteristics. The Tobit model supposes that there is a latent unobserved variable gi* that depends linearly on zi through a parameter vector α. There τi is a normally distributed error term to capture the random influence on this relationship. The observed variable gi is defined as being equal to the latent variable whenever the latent variable is above zero and equal to zero otherwise (Equation IV).

(IV)

(IV)

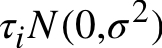

13Where gi* is a latent variable:

14If the relationship parameter α is estimated by regressing the observed gi on zi the resulting Ordinary Least Squares estimator (OLS) is inconsistent. Freeman et al. (13) have proven that the likelihood estimator suggested by Tobin (30) for this model is consistent.

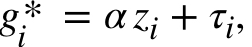

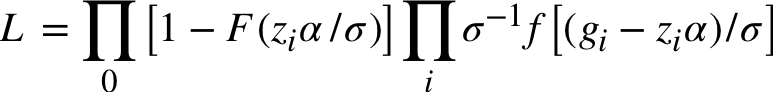

15The likelihood function of the model (4) is given by L (Equation V).

(V)

(V)

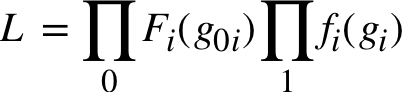

16Where f and F are the standard normal density and cumulative distribution functions, respectively. Then we can write the log-likelihood function (Equation VI).

(VI)

(VI)

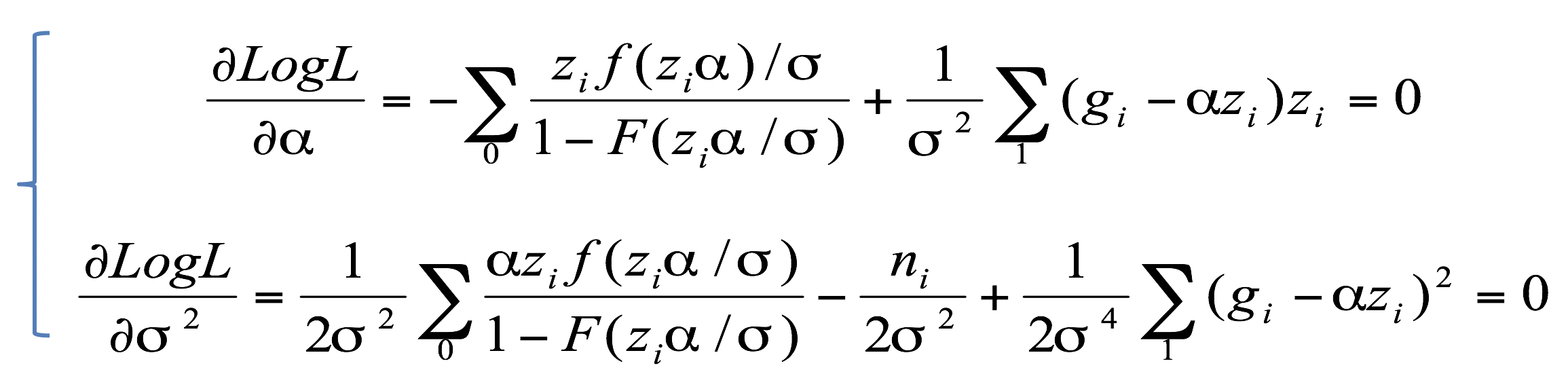

17are estimated by maximizing the log-likelihood function (Equation VII).

(VII)

(VII)

18Iterative process is usually employed to obtain the maximum likelihood estimator of (equation VII), since they are non-linear.

19The variables used in the analysis are presented in table 1. The dependent variable indicating the cassava farmers' access to credit is measured by the total amount of credit obtained from all available credit sources, for the productive season under investigation.

20Table 1. Variable definition and description.

|

Variable |

Definition |

Mean |

SD |

|

CREDITACCESS |

Dummy = 1 if farmer has access to credit |

0.17 |

0.38 |

|

LANDPRESS |

Pressure on the farm land calculated as total farm size divided by the household size |

3.74 |

3.36 |

|

RENTEDLAND |

Dummy = 1 if the farmer rented the land for farming |

0.76 |

0.43 |

|

DEPENDRATIO |

The ratio of dependents to the total household size |

0.64 |

0.78 |

|

AGE |

The age of the household heads in years |

50.00 |

16.00 |

|

AGE2 |

Square of the age of household head |

2754.42 |

1643.09 |

|

TTLU |

Total livestock unit |

0.39 |

0.47 |

|

GENDER |

Dummy = 1 if the household head is male |

0.83 |

0.38 |

|

EDUC |

Years of formal education, 0 otherwise |

6.00 |

4.89 |

|

LAND |

Total farm size |

2.59 |

2.44 |

|

OWNTELE |

Dummy = 1 if farmer owns television, 0 otherwise |

0.40 |

0.49 |

|

OUTPUT |

Cassava output in kg |

3523.36 |

2878.08 |

|

ACCINFOASSET |

Dummy = 1 if the farmer has radio, mobile phone or television set, 0 otherwise |

0.86 |

0.34 |

|

NFINC |

Dummy = 1 if the farmer participate in off-farm activities |

0.27 |

0.44 |

|

HHSIZE |

The total household size ( number) |

4.00 |

2.00 |

|

NPRODASSET |

Monetary value of non-farm assets ( |

72988.43 |

84396.05 |

|

PRODASSET |

Monetary value of farm assets ( |

11052.84 |

9966.942 |

|

EKITIDUM |

Dummy = 1 if the farmer is from Ekiti State |

0.10 |

0.30 |

|

OGUNDUM |

Dummy = 1 if the farmer is from Ogun State |

0.15 |

0.35 |

|

ONDODUM |

Dummy = 1 if the farmer is from Ondo State |

0.19 |

0.39 |

|

OSUNDUM |

Dummy = 1 if the farmer is from Osun State |

0.24 |

0.43 |

21Source: IITA2 /DIIVA3 Survey, (2011).

222 International Institute of Tropical Agriculture.

233 Diffusion and Impact of Improved Varieties Adoption in Africa.

24Following the literature on the determinants of access to credit (5, 19, 24), the following explanatory variables were included in the model: the farmers' age, farm size, total livestock units, household size, years of formal education, monetary value of household productive assets, income from off-farm employment, own television, rented land for farming, gender of the household head, and total cassava output. The empirical model is presented equation VIII.

25CREDITAMT=f (AGE, GENDER, OUTPUT, PRODASSET, LAND, HHSIZE, (VIII)

26NFINC, TTLU, RENTEDLAND, OWNTELE, EDUC)

27The family ability as proxy by AGE of the household head is hypothesized to be negatively related to the dependent variable. This implies that the younger farmers who tend to be more risk neutral are expected to have better and easier access to credit than the older farmers. GENDER is a dummy variable that takes the value of 1 if the household head is male and zero otherwise and was hypothesized to be positively related to the dependent variable. This is because male-headed households have more access to credit than the female-headed households. It has been observed by Mehra and Rojas (23) that women are able to access only one percent of credit in agriculture. This poor access to credit facilities prevents women from purchasing the needed inputs for agricultural purpose and is hampering women's productivity in agriculture (10). Total farm output is hypothesized to be positively related to the dependent variable. The higher the output, the larger the amount of credit a farmer will be likely to obtain.

28The household endowments measured by the monetary value of the household production assets is hypothesized to be positively related to the dependent variable. The farmers' farming and loan repayment capacity proxy by the area of farmland is hypothesized to be positively related to the dependent variable. This is because the size of the farmland owned by a farmer is an indication of wealth and perhaps a proxy for social status and influence within a community. Family labor endowment represented by the number of people in the household is also hypothesized to be positively related to the dependent variable. Income earned through non-farm employment is also expected to be positively related to the dependent variable. Off-farm income will reduce the perception of risk and increase the likelihood of access to credit.

29Total Tropical Livestock Unit (TTLU) which is used as a measure of the household livestock endowment was calculated using the following conversion factors for the livestock: 0.7, 0.2, 0.1, and 0.01 for cattle, pig, Shot (goat/sheep) and poultry, respectively. TTLU is expected to be positively related to the dependent variable, as they may act as productive assets (oxen and manure) and can also act as additional sources of household income (1). Land ownership status is a dummy variable that is 1 if the farmer rented land for farming and it is hypothesized to be negatively related to the dependent variable. Other household non-productive asset include a television set which is a dummy variable that takes the value of one if the household has a television and zero otherwise. The non-productive asset is also a measure of the financial strength of the farmers and is also hypothesized to be positively related to the dependent variable. Education of household head is measured by the number of years of schooling and it is hypothesized to be positively related to the dependent variable. The maximum likelihood estimates of the Tobit model was carried out using STATA 11.0 statistical package.

Results and discussion

30The definition and description of the variables used for the empirical analyses is presented in table 1. The average age of the respondents is 50 years. The majority of the respondents (83%) are male, with an average household size of four persons. The average farm size is 2.59 ha, with an average land pressure of about 4 persons per hectare, translating into about 0.65 ha per person. This shows that land access is a problem among the cassava farmers and this could be reason why about 76% of the respondents are cultivating cassava on rented farmland. The respondents are literate with an average of six years of formal education. Access to credit is a major constraint to agricultural production as evidently revealed by the small number (17%) of farmers that have access to credit. A larger percentage (86%) of the respondents have access to information enhanced assets such as radio, mobile phone, and television. The average monetary value of the respondents' farm and non-farm assets is about N 11, 052.84 and N 72, 988.43, respectively. This suggests that the farmers are creditworthy, since they could use some of these assets as collateral to gain access to credit.

31Table 2 presents the test of the mean differences in some selected socioeconomic characteristics of the farmers by access to credit. This test was carried out to showcase the relevance of access to credit in increasing smallholder farmers output and income. Farmers that have access to credit are not entirely similar to those that did not have access to credit. Those farmers that have access to credit have statistically significant higher yield (increase productivity), productive and non-productive assets, than those farmers that have no access to credit. In addition, farmers that have access to credit were able to spend more on agricultural production. This is indicating that access to credit can enable the farmers to acquire yield increasing inputs such as fertilizer, seed and agrochemicals.

32Table 2. Test of Mean Differences in Socioeconomic Characteristics by Access to Credit.

|

Variable |

Combined |

Access to credit = 1 |

Access to credit = 0 |

Mean Difference |

t-test |

|

Farm size (ha) |

2.59 (0.08) |

3.04 (0.20) |

2.48 (0.09) |

0.56 (0.21) |

2.67*** |

|

Yield (kg/ha) |

15408.19 (439.081) |

17128.56 (1038.82) |

14976.8 (482.43) |

2151.76 (1094.82) |

1.97** |

|

Productive (Farm) Asset value ( |

11,052.84 (344.09) |

13,488.38 (819.99) |

10,447.57 (374.88) |

3040.81 (855.43) |

3.55*** |

|

Non-productive ( non-farm) asset value ( |

72,988.43 (2913.68) |

83,417.66 (6788.58) |

70,396.65 (3217.71) |

13021.02 (7287.74) |

1.79* |

|

Agricultural expenditure ( |

1845.04 (217.05) |

3041.92 (828.68) |

1554.94 (178.74) |

1486.98 (545.67) |

2.73*** |

33Source: IITA/DIIVA Adoption and Impact Survey (2011)

34Note: figures in parentheses are the standard errors and *, ** and *** means statistically significant at 10%, 5% and 1% levels respectively.

35Table 3 presents the distribution of the farmers according to some socioeconomic characteristics. Male-headed households dominate cassava production in Nigeria. This is understandable in view of the tedious nature of some of the activities (weeding, harvesting etc.) involved in cassava production. About 76% of the respondents are between 18 and 60 years of age. This has a positive implication for cassava productions. As farmers age and gain experience, he or she may become more productive with improved managerial ability. Thus, it is expected that the farmers would be highly productive if they have access to credit which will enable them to purchase adequate productivity enhancing inputs at the right time. About 73% of the respondents have a household size of between 1 and 5 persons, while about 26% have between 6 and 10 persons. About 27% of the respondents cultivate less than 1 ha of farmland. Most respondents cultivate between one to four hectares of farmland. This shows that cassava production in Nigeria is still largely concentrated in the hands of small-scale farmers. About 39% of the farmers are literate with only primary education. This level of education will afford the farmers the opportunity to read and write and also to be able to process information that can enhance their access to credit. Despite this endowment, only about 20% of the farmers demanded for credit out of which only 17% had access to the credit. In addition, 17% acquired the credit for agricultural production purposes, while 4% obtained the credit for other non-agricultural purposes. About 9% of the farmers obtained the credit for both agricultural and non-agricultural purposes.

36Table 3. Distribution of Respondents according to Socioeconomic Characteristics.

|

Socioeconomic characteristic |

Number of respondents |

Percentage |

|

Gender Male Female |

707 149 |

82.59 17.41 |

|

Credit Demand for credit (1= yes)) Access to credit (1= yes) Acquire credit for agricultural production (1= yes) Acquire credit for non-agricultural purposes(1= yes) Acquire credit for both agricultural and non-agricultural purposes |

167 146 146 35 81 |

19.51 17.06 17.06 4.09 9.46 |

|

Household size (Total number of persons in the household) 1-5 6-10 > 10 |

625 221 10 |

73.01 25.82 1.17 |

|

Age (years) < 31 31-40 41-50 51-60 61-70 71-80 > 80 |

113 148 228 160 120 73 14 |

13.20 17.29 26.64 18.69 14.02 8.53 1.64 |

|

Years of Formal Education 0 1-6 7-12 13-16 > 16 |

243 333 204 58 9 |

28.39 38.90 23.83 6.78 1.05 |

|

Farm Size (Ha) > 1 1-2 2.1-3 3.1-4 4.1-5 5.1-6 6.1-7 7.1-8 > 8 |

235 273 102 102 24 20 9 38 50 |

27.45 31.89 11.92 11.92 2.80 2.34 1.05 4.44 5.84 |

37Source: IITA/DIIVA Survey, (2011).

38The assessment of credit demand, obtained credit, and credit constraint status of the farming households is presented in table 4. The analysis shows the different reasons/purposes for which credit was demanded. The reasons were broadly categorized into agricultural and non-agricultural purposes. The major reasons for demanding a loan for agricultural uses was related to planting material purchases (24.02%), fertilizer purchases (15.14%), farm operations (27.94%), and land acquisition (2.87%). The main reasons for which credit is demanded for non-agricultural uses related to business/trade (4.44%), food (4.18%), children's education (11.23%), health medical (5.48%), and other social obligations such as burial, marriage, and naming ceremonies (4.69%). Overall, 383 farmers demanded for credit, while only 157 (40.99%) of the farmers actually obtained the credit. This shows that there are credit market imperfections in Nigeria and this could limit the investment and operation of the farms. Most importantly, credit constraints can limit the size of farms, as well as their growth, profits, and scope of operation. Above all it has a detrimental effect on poverty reduction.

39Table 4

40Proportion that demand credit for Agricultural and Non-Agricultural Uses.

|

Demand credit |

Acquire credit |

Credit constrained |

||||

|

Uses of Credit |

Freq. (A) |

% |

Freq. (B) |

% |

Freq. (AB) |

% |

|

Agricultural Planting material Fertilizer Crop operations Land Acquisition |

92 58 107 11 |

24.02 15.14 27.94 2.87 |

45 20 39 3 |

28.66 12.74 24.84 1.91 |

47 38 68 8 |

20.79 16.81 30.09 3.54 |

|

Non-agricultural Business or trade Food Children’s education Health/medical Social obligations Total |

17 16 43 21 18 383 |

4.44 4.18 11.23 5.48 4.69 100 |

4 6 21 8 11 157 |

2.55 3.82 13.38 5.09 7.00 100 |

13 10 22 13 7 226 |

5.75 4.42 9.73 5.75 3.09 100 |

41Source: IITA/DIIVA Survey, (2011).

42Table 5 presents the distribution of the respondents according to the amount of credit obtained for agricultural purposes. The average amount of credit obtained for agricultural production purposes was N 6338.90. A larger percentage (86%) of the respondents obtained about N 5000. About 3% of the respondents obtained between N 16,000 and N 20,000. A negligible proportion (0.95%) obtained above N 100, 000. This reveals that the amount of credit required by the farmers is still very small, in spite of the need for credit for varieties of farm operations.

43Access to credit is also an important source of cash for the farmers to meet other household financial needs aside from farming operations. Many other needs listed by the farmers include payment of children school fees, food, off-farm business, family health, and other social obligations which include ceremonies such as naming, marriage, and burial. Fulfilling all these needs through access to credit can also improve the farming households' well-being. Average credit obtained for non-agricultural purposes is N 3788.79. As shown in Table 6, a large percentage (84%) of the respondents got between 0 and N 5000. About 3% obtained between N 51,000 and N 100,000. Only eight of the respondents (0.94%) obtained more than N 200,000 for non-agricultural purposes.

44Table 5

45Distribution of Respondents According to Amount of Loan Obtained for Agricultural Production.

|

Amount ( |

Frequency |

Percentage (%) |

46Source: IITA/DIIVA Survey, (2011).

47Table 6

48Distribution of Respondents According to Amount of Loan Obtained for Non-Agricultural Production.

|

Amount ( |

Frequency |

Percentage (%) |

|

0-5000 |

723 |

84.46 |

|

6000-10,000 |

10 |

1.17 |

|

11,000-15,000 |

9 |

1.05 |

|

16,000-20,000 |

20 |

2.34 |

|

21,000-30,000 |

19 |

2.22 |

|

31,000-40,000 |

17 |

1.99 |

|

41,000–50,000 |

17 |

1.99 |

|

51,000-100,000 |

22 |

2.57 |

|

110,000200,000 |

11 |

1.29 |

|

> 200,000 |

8 |

0.94 |

|

Total |

856.00 |

100.00 |

49Source: IITA/DIIVA Survey, (2011).

50Estimation result of the Tobit model of amount of credit obtained

51The result of the estimation of the Tobit model of the intensity of credit access is presented in table 7. Due to some missing data only 817 observations in our data set were used in the analysis. The final log likelihood is -2058.58 and the likelihood ratio chi-square of 36.55 (df = 11) with a P-value of 0.0002 implies that the model as a whole fits significantly better than an empty model (i.e., a model with no predictors).

52Tobit regression coefficients are interpreted in the similar manner to OLS regression coefficients; however, the linear effect is on the uncensored latent variable, not the observed outcome (McDonald, 1980). The empirical model of the Tobit model indicates that 10 out of the 11 variables included in model have the hypothesized signs. The sign of OWNTELE variable is not consistent with our expectation. However, only seven variables significantly (positively and negatively) affect the farmers' decision to access credit

53The coefficient of the LAND, GENDER, EDUC and NFINC, variables are consistent with our expectation, but not statistically significant. The estimated coefficient of the TTLU variable is positive and statistically significant at 5%. The positive sign as expected, implies that farmers with more livestock are more likely to obtain credit. For a unit change in number of livestock, there is 21,841.84 point increase in the predicted value of the amount of credit obtained by the farmers.

54The estimated coefficient of cassava output (OUTPUT) variable is positive and statistically significant at 10%, which implies that cassava output has a positive effect on the amount of credit obtained by the farmers. For a unit increase in cassava output, there is 2.00 point increase in the predicted value of the amount of credit obtained by the farmers. The term for OWNTELE and RENTLAND variables has a slightly different interpretation. The predicted value of amount of credit obtained by the farmers is -22,887.10 point lower for the farmers that own television than for those that did not. In the same vein the predicted value of the amount of credit obtained by the farmers that rented land for farming is -24,994.69 point lower for those farmers that rented the farmland than for those that own the farmland.

55The estimated coefficient of the PRODASSET variable is positive and statistically significant at 10%, which suggests that the monetary value of the farmers' productive assets such as hoes, cutlass, machetes, wheelbarrow, sprayers, etc. has a positive effect on the amount of credit obtained. In addition, for a unit increase in the households' productive asset, there is 0.97 point increase in the predicted value of the amount of credit obtained by the farmers.

56The estimated coefficient of AGE of household head variable is negative and statistically significant. This implies that the age of the household has a negative effect on the amount of credit obtained. Specifically, younger farmers are more likely to obtain credit than the older farmers and for a unit increase in age, there is a -604.15 point reduction in the amount of credit obtained. This could be because older farmers, due to experience are more risk averse than the younger farmers. The coefficient of the HHSIZE variable is positive and statistically significant at 10%. This shows that the larger the household size, the higher the amount of credit a farmer will obtain. A unit increase in the number of the household members increases the amount of credit obtained by 3889.32 points. The ancillary statistic/sigma is analogous to the square root of the residual variance in OLS regression.

57Table 7

58Estimation result of the Tobit model of amount of credit obtained.

|

Variable |

Coefficient |

Std. Err. |

t-value |

P>t |

|

NFINC |

329.09 |

975.59 |

0.34 |

0.736 |

|

TTLU |

21,841.84** |

10,505.98 |

2.08 |

0.038 |

|

OUTPUT |

2.00* |

1.11 |

1.81 |

0.071 |

|

OWNTELE |

–22,887.10** |

10,991.40 |

–2.08 |

0.038 |

|

RENTEDLAND |

–24,994.69** |

11,031.10 |

–2.27 |

0.024 |

|

LAND |

2547.26 |

2112.11 |

1.21 |

0.228 |

|

PRODASSET |

0.97* |

0.55 |

1.77 |

0.078 |

|

AGE |

–604.15* |

349.93 |

–1.73 |

0.085 |

|

GENDER |

1712.06 |

15,281.33 |

0.11 |

0.911 |

|

HHSIZE |

3889.32* |

2337.07 |

1.66 |

0.096 |

|

EDUC |

503.57 |

1132.67 |

0.44 |

0.657 |

|

CONSTANT |

–92,799.37*** |

28,282.97 |

–3.28 |

0.001 |

|

/sigma |

95,616.36 |

6596.01 |

||

|

Log likelihood |

–2058.58 |

|||

|

Number |

817.00 |

|||

|

LR Chi2(11) |

35.75 |

|||

|

Prob > chi2 |

0.0002 |

|||

|

Pseudo R2 |

0.0086 |

|||

59Source: IITA/DIIVA Survey, (2011).

60Note: *, ** and *** means statistically significant at 10%, 5% and 1% levels, respectively.

Conclusion

61Using cross-sectional data collected in 2011 from a total of 871 smallholder cassava farmers, this study assess the relationship between socio-economic characteristics, access to credit and intensity of credit use among smallholder cassava farmers in south-Western Nigeria .The analysis shows that majority of the smallholder cassava farmers in Nigeria are still credit constrained. The result further shows that the cassava farming households that are better endowed in terms of output, and assets are more likely to have access to credit than the un-endowed counterparts. This could mean that investment in assets (productive and non-productive) and diversification of household income sources to livestock could serve as a collateral security for access to credit, and hence increase the amount of credit a farmer could have access to. Although, there are existing programs and policies targeted at granting farmers access to credit, this study recommend that policies and programs that could also lead to improvement in cassava production, income diversification and asset accumulation will ultimately influence the amount of credit obtained by the farmers and should be promoted and adequately monitored. These programs and policies should also be targeted at the older farmers, since the younger one are more likely to have access to credit than the older ones.

Bibliography

62(1) African Agricultural Technology Foundation (AATF), 2009, Baseline study of smallholder farmers in Striga infested maize growing areas of Eastern Tanzania, Nairobi, Kenya.

63(2) Anderson T.B. & Malchow-Moller N., 2006, Strategic Interaction in Credit Markets. J. Dev. Econ., 80, 2, 275-298.

64(3) Aliou D. & Zeller M., 2001, Access to Credit and its Impact on Welfare in Malawi, International Food Policy Research Institute, Washington, D.C

65(4) Badiru I.O., 2010, Review of small farmer access to credit in Nigeria. Nigeria Strategic Support Program. International Food Policy Research Institute (IFPRI), Abuja, Nigeria. Policy note, No. 25.

66(5) Baffoe G. & Matsuda H., 2015, Understanding the Determinants of Rural Credit Accessibility: The Case of Ehiaminchini, Fanteakwa District, Ghana. J. Sustainable Dev., 8, 183.

67(6) Bali S.R., 2001, Demand, segmentation and rationing in the rural credit markets of Puri. Dissertation. Department of Economics, Uppsala University.

68(7) Bashir M.K., Mehmood Y. & Hassan S., 2010, Impact of agricultural credit on productivity of wheat crop: Evidence from Lahore, Punjab, Pakistan. Pak. J. Agric. Sci., 47, 405-409.

69(8) Bell C., Srinivasin T.N. & Udry C., 1997, Rationing, Spill-over, and Interlinking in Credit markets: the Case of Rural Punjab. Oxford Economic Papers. Oxford University Press, 4, 49, 557-585.

70(9) Besley T., 1995, Property Rights and Investment Incentives: Theory and Evidence from Ghana. J. Political Econ., 103, 5, 903-937.

71(10) Boserup E., 1970, Women's Role in Economic Development. New York: St. Martin's Press.

72(11) Boucher S.R., Carter M. & Guirkinger C., 2007, Credit Constraints and Productivity in Peruvian Agriculture. Working Paper No. 07-005. Department of Agricultural and Resource Economics, University of California - Davis.

73(12) De Klerk T., 2008, The Rural Finance Landscape: A practitioners Guide. Agromisa.

74(13) Freeman H.A., Ehui S.K. & Mohammad A.J., 1998, Credit constraints and smallholder dairy production in the East African Highlands: application of a switching regression model. J. Agric. Econ., 19, 33-44

75(14) Ghate P.B., 1992, Interaction between the Formal and Informal Financial Sectors: The Asian Experience, World Development, No. 1. XIV.

76(15) Gonzalez-Vega C., 2003, Lessons for rural finance from microfinance revolution. In: Wenner Mark, Javier Alvarado, and Francisco Galarza (eds.), Promising Practices in Rural Finance: Experiences from Latin America and the Caribbean. Washington, DC: Inter-American Development Bank.

77(16) Hoff K. & Stigliz J.E., 1990, Introduction: Imperfect Information and Rural Credit Markets-Puzzles and Policy Perspectives. World Bank Econ. Rev., 4, 3, 235-250.

78(17) International Financial Corporation (IFC), 2013, Working with Smallholder Farmers: A Handbook for Firms Building Sustainable Supply Chains. IFC, World Bank Group, Washington, D.C. 20433, USA.

79(18) Kashuliza A.K., Hella P., Magayane F.F. & Mvena Z.S.K., 1998, The role of Informal and Semi-formal Finance in Poverty Alleviation in Tanzania: Results of a field study in two regions of REPOA. Research Report No 98.1.

80(19) Kiplimo J.C., Ngenoh E., Koech W. & Jullius K.B., 2015, Determinants of Access to Credit Financial Services by Smallholder Farmers in Kenya. J. Dev. Agric. Econ., 7, 9, 303-313.

81(20) Kochar, A, (1997). Does Lack of Access to Formal Credit Constrain Agricultural Production? Evidence from the Land Tenancy Market in Rural India. Am; J. Agric. Econ., 79, 754-763.

82(21) Madalla G.S., 1983, Limited dependent and qualitative variables in Econometrics, Cambridge University Press.

83(22) Meehan F., 2001, Usage and Impact of Micro-Credit Provision: A case Study Based on the Credit Operations of Dedebit Credit and Saving Institution (DECSI), Tigray Ethiopia. A Paper Presented at the International Workshop on Dimensions of Microfinance Institutions in Sub-Saharan Africa: Relevance of International Experience. Mekelle University, Mekelle.

84(23) Mehra R. & Rojas M.H., 2008, Food security and agriculture in a global marketplace: A significant shift. Washington, D.C.: International Centre for Research on Women.

85(24) Ololade R.A. & Olagunju F.I., 2013, Determinants of Access to Credit among Rural Farmers in Oyo State, Nigeria. Global J. Sc. Frontier Res. Agric. Vet. Sci., 13, 2.

86(25) Omonona B.T., Lawal O.J. &Oyinlana A.O., 2010, Determinants of Credit Constraint Conditions and Production Efficiency among Farming Households in Southwestern Nigeria. African Association of Agricultural Economists (AAAE). 2010 AAAE.Third Conference/AEASA 48th Conference, September 19-23, 2010, Cape Town, South Africa. http://purl.umn.edu/95775.

87(26) Petrick M., 2004, Credit rationing of Polish Farm Households. A theoretical and empirical analysis: Studies on the Agricultural and Food Sector in Central and Eastern Europe.

88(27) Rahaji M.A. & Fakayode S.B., 2009, A Multinomial Logit analysis of Agricultural Credit Rationing by Commercial Banks in Nigeria. Int. Res. J. Fin. Econ., 24, 2450-2887.

89(28) Sadick M., Egyir I.S. & Amegashie D.P.K., 2013, Social Capital and Access to Credit by Farmer Based Organizations in the Karaga District of Northern Ghana. J. Econ. Sustainable Dev., 4, 16, 146-155.

90(29) Schultz T.W., 1964, Transforming Traditional Agriculture. New Haven: Yale University Press.

91(30) Tobin J., 1958, Estimation of relationships for limited dependent variables, Econometrica, 26, 1, 24-36.

92(31) Tsehay T. & Mengistu B., 2002, The Impact of Microfinance Services Among Poor Women in Ethiopia, Occasional Paper No. 6, Association of Ethiopian Microfinance Institutions (AEMFI), Addis Ababa, Ethiopia.

93(32) Steel S.F. & Andah D.O., 2004, Implications for development and performance: Report for industry. Accra: International Conference on Ghana at Half Century.

94(33) Simtowe F. & Zeller M., 2007, The Impact of Access to Credit on the Adoption of hybrid maize in Malawi: An Empirical test of an Agricultural Household Model under credit market failure. Afr. Association Agric. Econ. Conference Proceedings, 131-145.

95(34) World Bank, 2013, World Development Report 2013.

96(35) Washington DC: World Bank and OUP Press