- Accueil

- Vol. 43 - 2021

- Le législateur bienveillant a imaginé un palliatif. Belgium’s pre-insolvency legislation and the resilience of commerce 1883-1914

Visualisation(s): 2664 (8 ULiège)

Téléchargement(s): 20 (0 ULiège)

Le législateur bienveillant a imaginé un palliatif. Belgium’s pre-insolvency legislation and the resilience of commerce 1883-1914

Résumé

Quand, en 1883, le législateur belge propose une réforme du droit des faillites, cette innovation légale est alors assez ambitieuse et d’une grande portée, surtout en comparaison à d’autres pays en Europe. La loi de juin 1883 fournit des bouées de sauvetage en matière de pré-insolvabilité ainsi, « le concordat préventif » devient la première procédure en Europe tendant à éviter la déclaration en faillite et se focalisant sur la continuité de l’entreprise. L’objectif de cette loi est d’établir la possibilité de négocier un accord sans courir le risque de faire faillite et d’être qualifié d’insolvable par une décision judiciaire. Cette procédure fait alors grand effet sur la possibilité de liquidation d’entreprises puisque des négociations peuvent être menées dans les chambres du tribunal de commerce entre les créditeurs et le débiteur indigent, et des procédures de pré-insolvabilité peuvent ainsi donner un second souffle aux entreprises en difficulté. On ne considère donc plus la dissolution des biens du débiteur comme la réponse usuelle à ses ennuis financiers.

Abstract

By proposing a reform of bankruptcy law in 1883, the Belgian legislator introduced an ambitious and far-reaching legal innovation, especially compared to other countries in Europe. The law of June 1883 would provide lifelines in pre-insolvency matters: a “preventive composition” was the first procedure in Europe to avoid declaring bankruptcy while focusing on the continuity of the business. Since then, the parting of the debtor's assets was no longer considered the usual outcome to his financial troubles: this law’s aspiration was to establish the possibility of negotiating an agreement without having to run the risk of going bankrupt and being declared insolvent by a court decision. This had a great effect on the possibility of company liquidation: from now on, negotiations could be carried out in the chambers of the commercial court between the creditors and the indigent debtor, and pre-insolvency proceedings could thus give a second breath to commerce in difficulty.

Table des matières

1. Introduction: Nineteenth-century insolvency practices and its historians

1Changing bankruptcy codes, insolvency procedure variables, the withdrawal of small and large enterprises from the market, the survival of firms in financial distress, cross-border insolvency directives and the harmonization of international bankruptcy mechanics. These are only a few examples of topics on the death of trade and the failures of commerce which have generated considerable interest in legal-historical literature globally for a couple of decades. Mainly French and Anglo-Saxon studies have indicated the direction of research: the works of amongst others Jean-Pierre Hirsch, Pierre-Cyrille Hautcoeur, Jérôme Sgard, John Armour, Paolo Di Martino and Albrecht Cordes broadened the appreciation of historical investigation into commercial legislation and practices.1 Belgian legal study of bankruptcy and insolvency measures of the past, however, is dropping behind. Only recently has Dave De ruysscher delved into the legal architecture of commercial failures and its different historic roots.2 De ruysscher’s pioneering inquiries on late nineteenth-century insolvency legislation in France, The Netherlands and Belgium show some peculiar novelties in the latter country – which must have been of significant influence on the nation’s economic performance. For instance, delegated judges were given broader qualification in commercial court arbitration, demonstrating a stronger focus on the continuation of industrial and workmanship activities. Yet, most of these in-court commercial and forensic practices have not yet been examined. In his much-read plea for an intensified historic approach to Belgian economic law, Dirk Heirbaut reviewed the still paltry state of company law.3 Heirbaut appropriately stated that legal practices of the past have received too little attention. Moreover, the study of nineteenth-century enterprise failures still is left untouched. This lack of interest is also incited through historiographical motives.

2The history of much of Belgium’s industrial epoch is written after achievements and prosperity. Both the First and the Second Industrial Revolution hold clear-cut narratives through the lens of successful enterprises. Nineteenth-century economic growth was built seemingly upon the vitality of industry and commerce. In the second phase of industrialization from 1880 onwards, it relied on scientific progress (innovation, inventions) and wielded new sources of energy (new raw materials, the popularization of electricity, modern industry branches).4 At the turn of the twentieth century, Belgium managed to upkeep its position – albeit rather frenetically – as Europe’s fifth exporter and one of the leading economic powers globally. During this Second Industrial Revolution, the small nation experienced a very trade boom and its mass production served “the workshop to the world”.5 Small businesses and commerce were the companies at the forefront of capital formation and productivity growth. The focus on success stories does business historians and economic scholars alike disregard the fact that this Belgian Belle Époque also was a period of trial and error, misfortune and failure. The nineteenth-century insolvency measures installed by the Belgian legislator, however, can prove vigour and resilience of enterprises. Statistician at the time, Toussaint Loua for instance, coined the ambiguous relationship between insolvency and economic growth already in 1877.6 The absence of an inquiry into Belgian insolvency regrettably delivers a schizophrenic and incomplete picture of this time of economic and commercial expansion: we are thus unable to see the whole picture yet. These economic failures in het past are blind spots in the heuristics of historiography, for the sources of failures and bankruptcies are scarce and often incomplete.7 There are some traces to be found in the archives of commercial courts: though few nineteenth-century archival records do exist, yet they are still scientifically untouched.8 In this article I will give some empirical examples from the commercialized urban region of Antwerp in the years 1880 to 19149. Doing so, this paper aims to understand the use and functioning of legal practices and jurisprudence arbitration in commercial courts. It thus provides a tentative assessment of the performance of pre-insolvency procedures and the viability of commerce in pre-war Belgium.

2. Belgian’s insolvency compositions preceding the Belle Époque

3In his overview of the so-called demography of Belgian enterprises, Fred Stevens dealt among other things with the (threatening) death of industries and trades, and briefly touched upon the existence of insolvency legislation in the decades before the First World War.10 Failure or even bankruptcy was, of course, lethal in the lifespan of enterprises. The insolvency proceedings in force were introduced by the Napoleonic Commercial Code; it was applicable in the Belgian territories since its inception in 1807.11

4Indigent merchants could start an insolvency proceeding at the commercial court, which began with a declaration in bankruptcy by the lay judge. Liquidation of the enterprise was the default outcome. Negotiations leading up to a composition (concordat) were possible afterwards, but requirements for compositions were high: the greater part of creditors had to consent, and they had to represent three fourths of the debts.12 The court was not allowed to impose compositions on the creditors if majority requirements were not met. The administration of the bankruptcy trust proved to be highly creditor-orientated. The legislator believed that the creditors’ assembly was the best suited for assessing the creditworthiness of their debtor and the measures to be taken. A commissioned judge (juge commissaire) was in charge of supervising the administration, while the actual administrators or trustees (agents and syndics) were usually chosen from amidst the creditors.13 The commissioned judge formulated the opinions of the creditors on the insolvent’s fate. This report meant the conclusion of the insolvency procedure when the commercial court issued its judgment: it decided whether the effects of the insolvent debtor were to be sold publicly or whether a composition was accepted. The creditors also had to agree if the debtor could be declared excusable: only if no traces of criminal behaviour had been found during the course of insolvency procedures, the debtor was made eligible for re-entry in the market. This was the so-important rehabilitation. But rehabilitation into economic life could only be granted after all debts had been paid.14

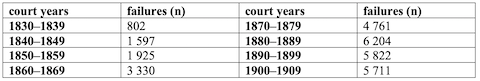

5The Belgian law of April 1851 on failure and composition tried to address the severe financial and economic crises, which had fanned the numbers of failures (table 1).15 The law revised the Commercial Code in a modest way.16 It did, however, introduce a new proceeding: a suspension of payments (sursis de paiement): with the approval of the majority of its creditors, representing at least three fourths of the debts in sums, the debtor could be granted a period of relief of at most one year. This moratorium was necessary for the debtor in order to recover following the protection against enforcement and the postponement of debts. Insolvency procedures could only start at the termination of payments (cessation des paiements), which was definitive insolvency.17 The suspension of payments was merely invoked to grant the debtor a temporary interruption. The bankrupt could obtain rehabilitation when the indebted money – the principal sum as well as interests and expenses – was settled.18 Rehabilitation and suspension of payments had to be pronounced by the Court of Appeal, of course, on the commercial court’s advice.

Table 1 – Failures pronounced by Belgian commercial courts and courts judging in commercial cases 1830-191019

Table 1 – Failures pronounced by Belgian commercial courts and courts judging in commercial cases 1830-191019

6Although the legislative modifications of the 1851 law were small, the legislator intended to make existing commercial court procedures more simple and cheaper.20

3. Legal innovation into perspective: Belgian’s pre-insolvency compositions 1883–1914

7Dave De ruysscher appropriately called the insolvency proceedings of the second half of the nineteenth century a hybrid legislation, and demonstrated the dysfunctional character of different existing insolvency proceedings approaches.21 The 1807 composition, upon insolvency, had been kept without changes. The 1851 suspension of payments was virtually never used (cf. infra). A third path to insolvency was the accelerated composition, a post-insolvency proceeding in which the debtor had to present himself as having the state of faillite, making him very vulnerable to liquidation.22 Moreover, the majority thresholds to be obtained by creditors were high for debtors wanting to start insolvency proceedings. Upon the existing insolvency proceedings, another practice was introduced in 1883.

8When the deteriorating economic conjuncture of the 1870s and 1880s ran the banking sector in deep water, because of the numerous liquidity problems caused by commercial failures, the Belgian legislator was incentivized to impose fundamental changes in the existing insolvency proceedings.23 The new proceeding was actually stacked upon previous insolvency procedures. But it propagated an original focus on the viability of trade and on the survival of commercial firms in distress, by means of a certain debtor-friendly approach (cf. infra). The law of 20 June 1883 gave birth to a pre-insolvency composition: the concordat préventif.24 This procedure had to precede insolvency, or to put it aptly: the indigent merchant was able to apply for this composition which could prevent him from becoming insolvent. Since the 1870s, some Belgian members of Parliament began to postulate the resilience of economy and in such a way the survival of merchants’ commerce and firms through insolvency proceedings.25 The state of failure was no longer the default outcome of insolvency proceedings: the Belgian “preventive composition” proceeding of 1883 was a pre-insolvency proceeding. Its purpose was to come to a negotiation between creditors and the debtor, without the latter running the risk of being dragged into liquidation. When the winding up of his business was inevitable, the merchant was allowed for a quick re-entry into the market, since the rules on rehabilitation did not apply.26 The dissolution of the debtor’s estate was no longer considered as the normal outcome if these negotiations with creditors did not succeed.

9Since 1883 debtors with financial difficulties could start four composition procedures. For all four, the commercial court was the competent court. Two kinds of proceedings of concordat were post-insolvency procedures (a “regular” proceeding or a “swift” proceeding), whilst sursis de paiement and concordat préventif were pre-insolvency procedures. This juxtaposition of procedures was the result of the layering of new proceedings on top of older ones. This divergent layering of insolvency legislation was dysfunctional and was often ineffective in actual practice. Several possible pathways towards an insolvency outcome formed an opaque playing field of various legal rules and different levels of risk of losing everything.27 Almost never used, the accelerated composition was abolished by the law of 29 June 1887.28 The suspension of payments was only granted 27 times between 1876 and 1887 but endorsed 21 times by the Court of Appeal. Between 1887 and 1900 the Belgian commercial courts granted 4 suspensions, of which 3 were turned down by the Court of Appeal.29 There is no disguising the fact that concordat préventif was the preferred pre-insolvency proceeding since the middle of 1883.

10From a historiographical perspective, the archival records of failures and insolvency compositions still are intact and virtually untouched. Only on a few occasions they made their way to historic inquiries. The pre-war preventive compositions of the commercial court of Namur for instance have been the most valuable subjects of examination by Serge Jaumain in the early 1990s and by undergraduate students of Emmanuel Debruyne, Gauthier Godart and Élise Rezsöhazy in 2017.30 In this contribution, I will put the pre-war preventive compositions of the commercial court of Antwerp to the test. The urban region of Antwerp was after all a highly commercialized region based upon the industrious economy of retail trade, small enterprises and merchant activity.

4. The performance of the pre-insolvency legislation 1883–1914

11Pre-insolvency proceedings were a legal innovation, quite far-reaching in accommodating pre-insolvency rescues as compared to legislation elsewhere in Europe.31 However, the contents of the law were not perfect. The legal framework had its flaws and the combination with other pre- and post-insolvency paths – regular concordat, accelerated concordat, suspension of payments – brought about ineffectiveness: this was already established by the provisional nature of the law. The law of June 1883 was after all conceived of as imposing exceptional and temporary measures. The 1883 reforms did not replace previous bankruptcy legislation but were placed on top of the existing laws and Commercial Code: La loi du 20 juin 1883 n’est qu’un essai.32 The law was conceived of as provisional; it was envisaged to be in force until the first of January 1886, and to be replaced with better alternatives later. Some magistrates actively advocated the repeal of these pre-insolvency proceedings and a return to the previous law, dating from the middle of the nineteenth century. In spite of this, the 1883 law was prolonged through consecutive laws in 1885 and 1887; it was only the latter law of 29 June 1887 that made it into a definitive arrangement. The legal framework was only refigured almost six decades later by the law of 10 August 1946: a large time span for proceedings which were merely meant to be temporary.33

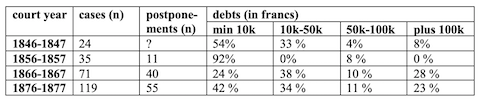

12Despite its dysfunctional constitution, the formal process of the preventive composition proved to be a well-functioning proceeding and took effect in fostering economic performance. Before 1883, members of Parliament had expressed their concern that existing insolvency formalities were expensive and took lots of time. An ever-increasing workload was perceptibly onerous in the commercial courts of commercialized regions, such as the province of Antwerp (table 2). This caused for ever more postponements of insolvency cases, and it bore heavily on the demography of enterprises. The impact of insolvency proceedings on the economic system lato sensu also became ever greater, as derived from the larger indebted sums dealt with.34

Table 2 – The workload in the province of Antwerp, before the introduction of pre-insolvency measures35

Table 2 – The workload in the province of Antwerp, before the introduction of pre-insolvency measures35

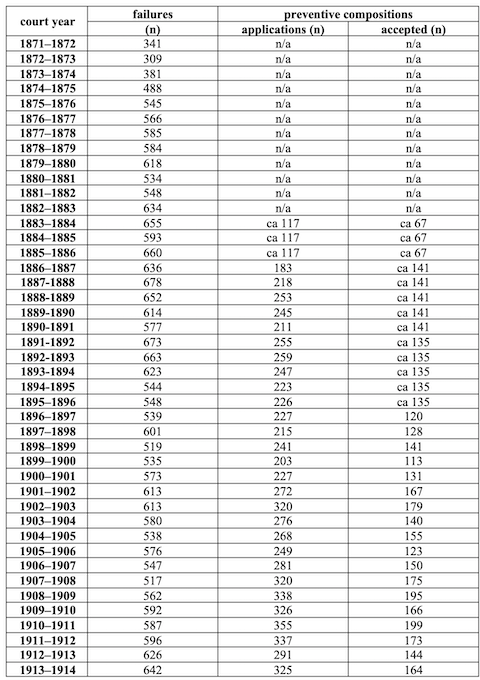

13This rise of failures and bankruptcies in the second part of the nineteenth century and the beginning of the twentieth century was a trend in commercialized regions (e.g. in the province of Antwerp) as well as at the aggregated, national level. The rising numbers of failures in Belgium (appendix) followed ever-increasing insolvency proceedings elsewhere in Europe, as documented in France by Luc Marco or in England and Wales by Paolo Di Martino.36

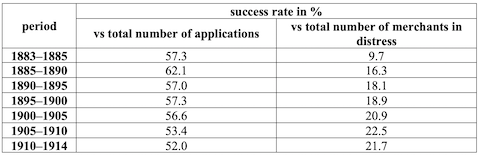

14The number of cases that fell under the pre-insolvency law increased more than proportionally with the rise of failures. This was especially the case for the city and surroundings of Antwerp: during the late nineteenth century there even was a considerable decrease of insolvency procedures (resulting in fewer failures in commerce) and a rise of initiated preventive compositions. The share of Antwerp merchants arriving at failure recorded a temporary low level around the turn of the century: somewhat 54 in 1884, ca 37 in 1894, 32 in 1904 and 52 in 1914. Whilst many indigent merchants at the same time applied for pre-insolvency negotiations at the commercial court or the court judging in commercial affairs: 39 in 1884, ca 50 in 1894, 58 in 1904 and 100 in 1914.37 The success rates were correspondingly high: around 50 percent to 60 percent of the requests was agreed upon. This percentage is in line with national ratios (table 3). Note that the post-insolvency composition – thus the composition after the state of faillite38 – was an equally popular way to wind up businesses, with 64 successful concordats in 1884, 39 in 1894, 39 in 1904 and 44 in 1914.

Table 3 – The success rate of the preventive composition in Belgium39

Table 3 – The success rate of the preventive composition in Belgium39

15These figures at least indicate that these pre-insolvency proceedings were a preferential means to avoid a withdrawal from the market. Léon Lowet, judge at the court of first instance of Charleroi, and Jules Destrée, attorney at the bar of Charleroi, acknowledged the relative popularity of the preventive composition and the growing acquaintance with the proceedings amongst merchants in distress. Nonetheless, Lowet and Destrée took stock of these procedures in 1892 in which they vented criticism. The two criticasters interpreted the pre-insolvency composition proceedings merely as temporary postponements of inevitable bankruptcy: Le législateur bienveillant a imaginé un palliatif. In their analysis of the legal practices, the composition was nothing more than a farewell anchor for merchants in despair (une ancre de salut).40 They denounced the judicial processes and the lenient way the courts interpreted and applied the ruling insolvency legislation. Although not explicitly mentioned, Lowet and Destrée seem to have had the layman judges of the commercial courts in mind – these were juges consulaires and thus no professional judges – ; other commentators at that time, on the other hand, were more explicit.41

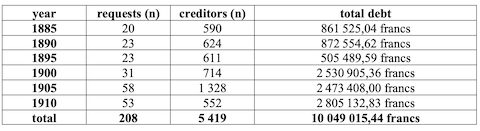

16Merchants and enterprises in financial difficulties could address a preventive composition request to the commercial court of their jurisdiction. I have analysed all 208 preventive composition requests initiated by the Antwerp commercial court from six sample years in the period 1884–1914. As to the professions, labels used in the sources included 3 artists, 40 craftsmen, 55 traders (commerçants, détaillants), 73 merchants (marchands, négociants), 10 manufacturers (fabricants) and 24 entrepreneurs. Debtors could be individuals, as well as firms: the most widely used company form was still the general partnership (société en nom collectif), but some limited partnerships (société en commandite (simple)) also found their way to the negotiation table. Corporations with fixed capital (sociétés anonymes) – such as the requests of the Société Anonyme Crédit Commercial Congolais and the Société Anonyme Restaurant Bertrand – were rather exceptional. Table 4 indicates that the preventive composition was getting ever more familiar in the merchant’s midst. The Antwerp applications represented large indebted sums, averaging 48,312.57 francs per debtor. On average, every debtor had to please 26 creditors, which usually came from different parts of the city of Antwerp, of Belgium, of Western-Europe or even of South Africa. At the negotiation table, Mr De Decker and Mrs Tillez both had only their 4 creditors to convince. Mrs Tillez, a trader from the city of Antwerp, was successful in defending her payment proposition. She had to come up with 30 percent of the total indebted sum of 11,748.48 francs: the first 10 percent had to be paid within two months after the homologation, the remaining 20 percent in the subsequent half a year.42 The Antwerp shipbuilder De Decker by contrast was not able to negotiate his proposed payment instalment over three years, despite the payment plan of the total amount of the indebted sum of 89,427.18 francs. There were just too many disputes around the negotiation table on the specific amounts of the different indebted sums.43 Another example: Victor Pecher and Charles Eduard Pecher of the Société en Commandite Simple Pecher & Cie did reach an agreement with 50 of their 57 creditors, with whom they would form a new company after homologation.44 At the time of their concordat préventif, they owed for a staggering 1,569,093.46 francs.

Table 4 – 208 preventive composition requests for the sampled years 1885–191045

Table 4 – 208 preventive composition requests for the sampled years 1885–191045

17The debtor’s appeal started with a letter to the court, in which the merchant specified that his troubles were by no means the result of fraudulent actions. In the sampled cases, many applicants referred to diseases, financial disappointments and mistakes by others while explaining their miserable and pathetic situation.46 On many occasions the merchant’s financial recklessness had led to overinvestments, as was also the case in Serge Jaumain’s research.47 The law of June 1883 stipulated that a preventive composition could be requested by the applicant who had not ceased payments in a permanent way and who was honest (honnête et loyal) but unfortunate (malheureux).48 The interpretation of the well-intentioned nature of the financial distress was solely dependent on the sovereign appraisal of the judge of the commercial court. As already mentioned, this judge was a layman: he was a merchant himself who, as a colleague of his fellow debtor and creditors, spoke justice. He decided whether the applicant was honest but unfortunate. The debtor making his preventive composition request also drew up a list of all creditors and the respective debts. Any possible mistake, omittance or conscious conceal was enough reason to halt the composition procedure, and file the insolvent as fraudulent. The Antwerp practice nonetheless shows many of these inaccuracies, together with a very forbearing attitude from creditors and judges around the negotiation table: on many occasions the merchant in distress forgot to declare additional sums or even important creditors.

18Having met these conditions, the commercial court opened a preventive composition proceeding and the creditors were individually invited to declare their debts (in this manner the court administration could verify or confront the debtor’s information). In order to reach all creditors on the list – or possible neglected creditors and their money due – a convocation was also made public through publication in the Moniteur belge and in a local newspaper. Especially the Antwerp periodicals Le (Nouveau) Précurseur (1835–1914) and De Koophandel/De Nieuwe Gazet (1863-present) were frequently used media channels. A first creditor meeting took place two weeks after the opening of the proceeding.

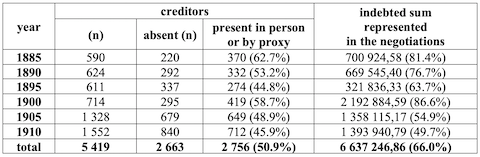

19The debtor had to make a proposal himself to reshuffle his debts. The proposition had to be approved of by a larger part of creditors, which represented at least three quarters of the total of indebted sums. These thresholds were high and the creditors had to cast their written vote beforehand. Nevertheless, the negotiation within the commercial court offered a forum to discuss pros and contras, and to even adjust many initial propositions in favour of the creditors. Diamond producer Thomas Swelsen for example had to finish his uncompleted manufacture first: all later production had to go to the creditors until a certain portion of each debt had been paid.49 After Maurice Frey declared his composition proposal to the creditors, they immediately raised the stakes. This indigent merchant in grains had to forfeiture all his assets, as he had proposed himself, but Frey also had to sell his automobile – a curiosity at that time.50 These negotiation meetings weren’t always that crowded. On the contrary: many creditors stayed away from the gathering with their debtor, solely relying on their written vote of acceptance or decline. In most cases, the creditors were acquainted with their debtor with whom they already had held talks and bargaining outside the court. The absence of creditors’ interests grew hand over hand (table 5). Moreover, creditors did not have to be present in person at all: a vast majority of creditors was represented at the table by mandate. Mandataries culminated as many proxy votes in the meeting, as they had mandates. These proxy-holders were sometimes experts from the field, such as merchants or traders, but generally they were legal professionals. Approximately nine out of ten mandated creditors were represented by advocates. For the most part, proxy-holders did not split votes: they promoted the interests of different creditors having the same intention to vote. Even the debtors with the most and largest debts and with dozens of creditors could convocate in a small negotiation gathering. It is quite striking that on only 4 out of 208 occasions, all creditors were present at the meeting (in person or through mandate).51

Table 5 – Bringing the creditors to the negotiation table

Table 5 – Bringing the creditors to the negotiation table

20Only when requirements for preventive composition were met, the commissioned judge of the commercial court was able to grant the concordat préventif. More than half of the 208 requests in Antwerp were adjudicated this pre-insolvency composition.

21The applicants of the 1883 law proposal saw this preventive insolvency regulation serving a social cause: it was the pre-eminent means to avert the social stigma of being insolvent.52 At the same time, the creditors were encouraged to accept the debtor’s proposition: when the merchant was under composition, the creditors could control its affairs. The rules of rehabilitation did not apply to preventive compositions, which was an incentive for debtors to apply for a pre-insolvency procedure: rehabilitation was after all costly and time consuming. Re-entry in the market via preventive composition consequently gave vitality to the commerce in financial difficulties. But when negotiation between debtor and creditor failed, the enterprise was not automatically lead into a death-struggle and subsequent liquidation. My preliminary findings show that Antwerp merchants could at least apply for a new preventive composition request on a second or even third occasion.53 Several debtors met their creditors again in the commercial court, months or even years after a first attempt, with a similar or very same debt balance and with a new proposal of payment by instalments. This is in contrast to what law and legal commentaries suggest.54 These second changes often resulted in the adjudication of a preventive composition, making the indigent commerce by no means palliative.

5. Conclusion

22Due to the rapidly changing character of commercial legislation in the past on the one side and a manifest lack of scholarly interest in the history of persons and businesses engaged in commerce and trade, on the other hand, a legal-historic interpretation of the Belgian (pre-)insolvency practice still is an untouched research area.

23When in 1883 the Belgian legislator came up with a bankruptcy law reform, this legal innovation was quite far-reaching as compared to legislation elsewhere in Europe. The law of June 1883 accommodated pre-insolvency rescues: it was the first European extra-bankruptcy proceeding to focus on the continuity of the firm. Since the partition of the debtor’s estate was no longer considered as the normal response to financial difficulties. The purpose of this law was to establish the possibility to negotiate a composition without running the risk of being dragged into liquidation and the legal categorization of insolvent (faillite). This impacted possible death struggles of enterprises greatly: from now on within-court arrangements could be negotiated between creditors and the indigent debtor, and pre-insolvency proceedings could thus inject new life into businesses in distress.

24The legal practices of this new pre-insolvency law, however, immediately were subject to polarizing polemics. The law was conceived of as temporary; it was envisaged to be replaced with better alternatives later – which never came. The proceedings of 1883 were layered, with different legal arrangements overlapping, and this was often dysfunctional. Some criticasters saw the 1883 pre-insolvency composition as nothing less than “palliative” and thus interpreted the proceedings merely as temporary postponements of inevitable bankruptcies.

25Despite this significant opposition, the 1883 law was applied for at least six decades. This raises questions regarding the feasibility of the very proceedings and of the practices of Belgian commercial jurisdiction in the past. This research therefore inquired businesses between life and death by examining the merchant appearing in commercial courts, and by looking into the resilience of Belgian commercial activities in these exciting times.

26Appendix 1 – Number of failures and preventive compositions in Belgium 1871–1914

Notes

1 J. -P. Hirsch, Les deux rêves du commerce. Entreprise et institution dans la région lilloise (1780-1860), Paris, Éditions de l’École des Hautes Études en Sciences sociales, 1991, p. 85-92 ; P. Di Martino and P.‐C. Hautcoeur, The Functioning of Bankruptcy Law and Practices in European Perspective c.1880-1913, in Enterprise and Society, vol. 14, 2012, p. 579-605; J. Sgard, Do Legal Origins Matter? The Case of Bankruptcy Laws in Europe, 1808-1914, in European Review of Economic History, vol. 3, 2006, p. 389-419; J. Armour, B. Cheffins and D. Skeel, Corporate Ownership Structure and the Evolution of Bankruptcy Law. Lessons from the United Kingdom, in Vanderbilt Law Review, vol. 55, 2002, p. 1699-1785; P. Di Martino, Dealing with Failure. Bankruptcy and Insolvency in the English Experience (1890-1939), in Histoire & Mesure, vol. 23, 2008, n° 1, p. 137-165; M. Beerbühl, Introduction, in M. Beerbühl and A. Cordes (eds.), Dealing with Economic Failure. Between Norm and Practice (15th to 21st Century), Frankfurt am Main, Lang, 2016, p. 9-25.

2 D. De ruysscher, At the End, the Creditors Win. Pre-Insolvency Proceedings in France, Belgium and the Netherlands (1807-c1910), in Comparative Legal History, vol. 6, 2018, n0 2, p. 184-206; D. De ruysscher, Legal Culture, Path Dependence and Dysfunctional Layering in Belgian Corporate Insolvency Law, in International Insolvency Review, vol. 27, 2018, 374-397; D. De ruysscher, Business Rescue, Turnaround Management and the Legal Regime of Default and Insolvency in Western History (Late Middle Ages to Present Day), in J. Adriaanse and J.-P. Van der Rest (eds.), The Routledge Companion to Turnaround Management and Bankruptcy, London, Routledge, 2017, p. 22-42.

3 D. Heirbaut, Een Pleidooi voor meer Geschiedenis van het Economisch Recht in België, in Pro Memorie. Bijdragen tot de Rechtsgeschiedenis der Nederlanden, vol. 12, 2010, n° 2, p. 212.

4 R. Boschma, New Industries and Windows of Locational Opportunity: A Long-Term Analysis of Belgium, in Erdkunde, vol. 51, 1997, p. 12-22; J. Lewinski, L’évolution industrielle de la Belgique, Brussels-Leipzig, 1911, p. 155-166; J. Mokyr, The Lever of Riches. Technological Creativity and Economic Progress, Oxford, Oxford University Press, 1990, 349 p.

5 G. Daudin, M. Morys and K. O’Rourke, Globalization, 1870-1914, in S. Broadberry and K. O’Rourke (eds.), The Cambridge Economic History of Modern Europe. Volume 2, 1870 to the Present, Cambridge, Cambridge University Press, 2010, p. 26-29; E. Buyst, De Evolutie van het Belgische Bedrijfsleven, 1850-2000, in B. Van der Herten, M. Oris and J. Roegiers (eds.), Nijver België. Het Industriële Landschap omstreeks 1850, Brussels, Uitgeverij MIM and Het Gemeentekrediet van België, 1995, 357-358; G. L. Fontana, The Economic Development of Europe in the Nineteenth Century (I). Growth and Transformation of the Economy, in A. Di Vittorio (ed.), An Economic History of Europe. From Expansion to Development, Oxford, 2006, p. 135-153.

6 T. Loua, Les faillites en France depuis 1840, in Journal de la Société de Statistique de Paris, vol. 18, 1877, p. 281-291.

7 Only a few failures have made well-documented case studies, benefitting from rich company archives, such as the notorious failures include of financial entrepreneur and salesman André Langrand-Dumonceau in 1870 and of the Bank Dujardin in 1874: G. Jacquemyns, Langrand-Dumonceau, promoteur d’une puissance financière catholique. Volume I. Années obscures – Montée, Brussels, Université Libre de Bruxelles, 1960, 320 p. ; A. Maertens, Leven & Dood van een Bank in de XIXe Eeuw. Een Bijdrage tot de Studie van het Economisch Verval en Herleven van Brugge en Omstreken in de Tweede Helft van de XIXe Eeuw, toen Brugge een Financieel Centrum was door Toedoen der Bank Dujardin, Bruges, Uitgeverij D. Walleyn, 1948, p. 151-157.

8 J. Bekers, Het Archief van de Rechtbanken van Koophandel in België (19de en 20ste Eeuw). Een Bron voor de Sociaal-Ekonomische Geschiedenis, in H. Coppejans-Desmedt (ed.), Economische Geschiedenis van België. Behandeling van de Bronnen en Problematiek. Handelingen van het Colloquium te Brussel, 17-19 Nov. 1971, Brussels, Archief- en bibliotheekwezen in België, 1973, p. 233-245; P. Drossens, Een nog te Ontginnen Bron voor Bedrijfshistorisch Onderzoek. Het Archief van de Rechtbank van Koophandel, in J. Derwael (ed.), Leveranciers en Klanten. Valorisatie van het Archiefaanbod voor Bedrijfshistorisch Onderzoek. Handelingen van de Studiedag van Vrijdag 7 Oktober 2005 te Kortrijk, Brussels, State Archives of Belgium, 2006, p. 93-99 (Miscellanea Archivistica. Studia, 167); P. Van den Eeckhout, Verder Kijken dan het Bedrijfsarchief. Aanvullende Bronnen op Papier, in C. Vancoppenolle (ed.), Een Succesvolle Onderneming. Handleiding voor het Schrijven van een Bedrijfsgeschiedenis. Nieuwe Herwerkte Uitgave, Brussels, State Archives of Belgium, 2005, p. 142 (Studia, 104).

9 I am grateful to my supervisor Dave De ruysscher, as well as to the participants of the Journées internationales d’histoire du droit et des institutions (Audenarde, May 31st & June 1st 2019) for their useful comments. This research is written with the financial support of the Research Foundation Flanders (FWO) project “Catering Pre-Insolvency Restructurings for the Needs of SMEs: Belgium (1850–1910)” (project code FWOAL899).

10 F. Stevens, Vie et mort des sociétés commerciales en Belgique. Évolution du cadre légal XIXe-XXe siècles, in M. Moss and Ph. Jobert (eds.), Naissance et mort des entreprises en Europe, XIXe-XXe siècles, Dijon, Université de Bourgogne, 1995, p. 13-14.

11 E. Holthöfer, Handels - und Gesellschaftsrecht. Belgien, in H. Coing (ed.), Handbuch der Quellen und Literatur der Neueren Europäischen Privatrechtsgeschichte, vol. 3, Munich, Beck, 1982, p. 3287-3389; J. -M. Thiveaud, L’Ordre primordial de la dette. Petite histoire panoramique de la faillite, des origines à nos jours, in Revue d’Économie financière, vol. 25, 1993, p. 86.

12 N. Praquin, Les faillites au XIXe Siècle. Le droit, le chiffre et les pratiques comptables, in Revue Française de Gestion, vol. 8, 2008, n° 188-189, p. 362.

13 D. De ruysscher, Legal Culture…, op. cit., p. 380. The majority of the creditors choose at least one fellow-creditor who had to oversee the execution of the debtor’s composition and had to follow-up the future liquidation of debts.

14 P.-C. Hautcoeur and N. Levratto, Bankruptcy Law and Practice in XIXth Century France, in Paris School of Economics Working Paper, vol. 29, 2007; D. De ruysscher, Bescheiden Toezichter of Bemiddelaar? De Plaats van de Rechter in Reorganisatie en Faillissement vanuit Historisch-Rechtsvergelijkend Perspectief, in Tijdschrift voor Privaatrecht, vol. 55, 2018, 147-148.

15 Law of 18 April 1851, Moniteur belge 24 April 1851; P. J. Maertens, Commentaire de la loi du 18 Avril 1851 sur les faillites, banqueroutes et sursis, suivi d’un formulaire complet de tous les actes relatifs à cette matière, Brussels, Imprimerie Polack-Duvivier, 1851, p. 509. The law of 18 April 1851 was altered many times, before it was repliced by the law of 8 August 1997 (Moniteur belge 28 October 1997).

16 E. Muys, De Rechtbank van Koophandel (1798-1999). Organisatie, Bevoegdheid en Archiefvorming, Brussels, State Archives of Belgium, 1999, p. 99-102 (Miscellanea Archivistica. Studia, 121).

17 D. De ruysscher, Legal Culture…, op. cit., p. 383.

18 Rehabilitation could even be granted when the bankrupt was already deceased: Code de Commerce, art. 586, § 3.

19 Statistique générale de la Belgique. Exposé de la situation du Royaume de 1861 à 1875, Brussels, 1885, p. 188-189 ; Statistique générale de la Belgique. Exposé de la situation du Royaume de 1876 à 1900, Brussels, 1907, p. 204 ; Administration de la Justice Criminelle et Civile de la Belgique. Résumé Statistique, vol. 1881-vol. 1914, Brussels.

20 P. Namur, Le Code de Commerce belge revisé, interprété par les travaux préparatoires des lois nouvelles par la comparaison avec la législation antérieure et par la doctrine et la jurisprudence, vol. 3, Brussels, Bruylant-Christophe, 1884, p. 3.

21 D. De ruysscher, Legal Culture…, op. cit., p. 384.

22 The debtor who declared himself insolvent could not be held culpable for treacherous behaviour towards the creditors. This resulted in a fast proceeding in order to reach a concordat. It was a legal curiosity and unknown in legal practice.

23 M. Bordo, An Historical Perspective on the Quest for Financial Stability and the Monetary Policy Regime, in The Journal of Economic History, vol. 78, 2018, n0 2, p. 342-348.

24 Law of 20 June 1883, Moniteur belge 23 June 1883.

25 A first attempt inspired by French legislation stranded in 1872. In 1879, two liberal members of Parliament submitted a proposal of law for providing debtors in financial difficulties with the possibility to deliberate on a scheme of debt with their creditors. This negotiation had to take place under the supervision of the commercial court. The aim was twofold: indebted merchants remained in possession of their estate, and they avoided the categorization of insolvent.

26 L. Lowet and J. Destrée, Du concordat préventif de la faillite. Commentaire pratique de la loi du 29 Juin 1887, Brussels, Larcier, 1892, p. 148.

27 For instance, while the regular post-insolvency concordat was intended for insolvency procedures that had been started by creditors, the debtor who declared himself insolvent (and thus could not be held culpable for treacherous behaviour towards his creditors) could start the accelerated proceeding for reaching a concordat. However, this swift post-insolvency concordat was very difficult to obtain: three fourths of the creditors, representing five sixths of the debts (in sums), were to approve the scheme that was drafted by the debtor.

28 D. De ruysscher, At the End…, op. cit., p. 196. Three fourths of creditors, representing five sixths of the debts (in sums), were to approve the scheme that was drafted by the debtor.

29 Statistique générale de la Belgique. Exposé de la situation du Royaume de 1876 à 1900, Brussels, 1907, p. 207.

30 S. Jaumain, Les petits commerçants belges face à la modernité, 1880-1914, Brussels, Université Libre de Bruxelles, 1995, p. 261 ; the workshop “Les Faillis et leur Devenir. Comment Survivre à la Faillite à la Belle Époque” at Louvain-la-Neuve on 24 March 2017. Emmanuel Debruyne traced the impact of failure on the lives of 21 individuals: E. Debruyne, Des faillis dans l’ombre de la « Belle Époque ». Faire face à l’échec, faire face à la honte. Belgique, 1896-1914, in Entreprises et Histoire, vol. 91, 2018, n° 2, p. 29-47.

31 P. Di Martino, The Historical Evolution of Bankruptcy Law in England, the US and Italy up to 1939. Determinants of Institutional Change and Structural Differences, in K. Gratzer and D. Stiefel (eds.), History of Insolvency and Bankruptcy from an International Perspective, Huddinge, Södertörns högskola, 2008, p. 263-279; P. Di Martino and P.-C. Hautcoeur, The Functioning of Bankruptcy Law…, p. 579-605.

32 Concordat Préventif de la Faillite, in Pandectes belges. Encyclopédie de législation, de doctrine et de jurisprudence Belges, Brussels, F. Larcier, 1887, p. 206.

33 E. Muys, De Rechtbank van Koophandel…, p. 113-114 and 119 (Miscellanea Archivistica. Studia, 121); C. Del Marmol, La Transformation des Procédures de Faillite et des Mesures Préventives sous l’Influence de la Crise Économique. Droit Belge, in Institut Belge de Droit Comparé, 1936, n° 2, p. 174-188 ; G. Aerts, Belgium. Insolvency Proceedings, in K. Cork and G. Weiss (eds.), European Insolvency Practitioners’ Handbook. The AEPPC Compendium of Insolvency Law and Practice, Hampshire, Macmillan Publishers Ltd., 1984, 4.

34 G. Devos, De Rechtbank van Koophandel te Antwerpen. 200 jaar ten Dienste van Handel en Industrie, in G. Devos (ed.), 200 Jaar Rechtbank van Koophandel Antwerpen, 1798-1998, Antwerp, Drukkerij De Bruyn NV, 1998, annexes.

35 Exposé de la situation de la province d’Anvers, vol. 1848, vol. 1858, vol. 1868 and vol. 1878, Antwerp.

36 L. Marco, La montée des faillites en France, 19e -20e siècles, Paris, L’Harmattan, 1989, 192 p. ; P. Di Martino, Dealing with Failure…, p. 137-165. On the spatial variation in the number of failures and the different geographies of insolvency law jurisprudence, see: P.-C. Hautcoeur and N. Levratto, Legal vs. Economic Explanations of the Rise in Bankruptcies in 19th Century France, in Revue d’Économie Industrielle, vol. 4, 2017, n° 160, p. 23-45.

37 These official numbers were registered in court years and differ slightly from my own calculations, based upon the composition requests in calendar years. Withal, the above-mentioned numbers not only refer to the cases judged at the Antwerp commercial court, but to the entire province of Antwerp.

38 Concordat (Faillite), in Pandectes belges. Encyclopédie de Législation, de Doctrine et de Jurisprudence Belges, Brussels, F. Larcier, 1887, p. 103-105.

39 The second column of this table shows the granted preventive compositions in proportion to the number of failures plus the number of pre-insolvency composition requests (thus all merchants in distress).

40 L. Lowet and J. Destrée, Du Concordat Préventif…, 272 p.

41 Concordat Préventif de la Faillite, in Pandectes Belges, op. cit., 1887, p. 205-206. A professional judge administered justice in the jurisdictions where there were no commercial courts.

42 State Archives of Antwerp, Commercial Court of Antwerp, series 9, n° 18: minutes of the session of 22 April 1890.

43 Ibid., series 9, n° 13: minutes of the session of 1 August 1885.

44 Ibid., series 9, n° 28: minutes of the session of 24 August 1900.

45 Ibid., series 9, n° 13, 18, 23, 28, 33 and 38: minutes of the sessions.

46 Ibid., series 6.

47 S. Jaumain, Les Petits Commerçants Belges…, op. cit., p. 260-261.

48 Concordat Préventif de la Faillite, in Pandectes Belges, op. cit.., 1887, p. 132 ; L. Lowet and J. Destrée, Du Concordat Préventif…, p. 7 ; D. De ruysscher, Bescheiden Toezichter of Bemiddelaar... , op. cit., p. 147-218.

49 State Archives of Antwerp, Commercial Court of Antwerp, series 9, n0 18: minutes of the sessions of 11 March 1890.

50 Ibid., series 9, n0 18: minutes of the sessions of 14 February 1890.

51 Absent creditors could still cast their vote at the commercial court’s registry within the week.

52 Célia Magras Vergez recently explored the fear of failure and theorized this enemy number one for business: C. Magras Vergez, La constance des stigmates de la faillite. De l’Antiquité à nos jours, Paris, Éditions La Librairie Générale de Droit et de Jurisprudence, 2019, 588 p. (Bibliothèque de droit des entreprises en difficulté, 18).

53 E.g. for the six sample years: State Archives of Antwerp, Commercial Court of Antwerp, series 9, n0 28: minutes of the sessions of 23 October 1900 and 28 November 1900; Ibid., series 9, n0 33: minutes of the sessions of 18 January 1905, 10 March 1905, 14 February 1890, 12 August 1905 and 7 October 1905; Ibid., series 9, n0 38: minutes of the sessions of 15 April 1910 and 22 September 1910.

54 This practice is unexpected and deserves further investigation. This will be the focus of closer study by me and by my supervisor Dave De ruysscher.

Pour citer cet article

A propos de : Pieter De Reu

Pieter De Reu obtained a master’s degree in History (Ghent University, 2007) and was a scientific researcher since. He subsequently worked at the State Archives of Belgium in Beveren and in Ghent, at the History Department of Ghent University and at the Department of Interdisciplinary Legal Studies of Vrije Universiteit Brussel. His research interests are in the fields of fiscal history and commercial law history, public institutions, heuristics in history and research methodology. In addition he publishes on property practices and property transfer in the past, as well as rural and industrial history.